11 July 2016, 12:36

Child benefits from July 1, 2016: changes and amounts

Due to the increase in the minimum wage, the size has changed. What are the new levels of child benefits? Does an accountant need to recalculate benefits already assigned? You will find answers to these and other questions in our article.

Introductory information

- monthly allowance child care up to 1.5 years old;

- maternity benefit.

At the same time, we note that in some regions of the Russian Federation a pilot experiment is being conducted to pay benefits directly from the Social Insurance Fund budget. FSS units in the experimental regions themselves calculate and pay “children’s” benefits to employees. Cm. " ".

If an organization or individual entrepreneur has employees to whom he is obliged to pay benefits, then the employer should know the amount of benefits in 2016, including the amount child benefits from July 1, 2016.

Indexation of benefits in 2016

The state annually indexes some “children’s” benefits, namely: at the birth of a child; for registration in early dates pregnancy; minimum amounts of benefits for child care up to one and a half years old. Maternity benefits are not indexed.

However, in 2016, legislators decided not to index benefits from January 1, 2016, as was done before. Therefore, if a child was born, say, in January 2016, then the birth benefit was supposed to be paid without indexation.

Officials provided for indexation by 7% only from February 1, 2016 (Article 4 Federal Law dated 04/06/2015 No. 68-FZ). In this regard, it turned out that in January 2016 there was one benefit amount, and from February 1 - another. We give the dimensions in the table.

| Benefit | Size in January 2016 | Size as of February 1, 2016 |

| Benefit for registration in early pregnancy | RUB 543.67 | RUB 581.73 (RUB 543.67 × 1.07) |

| One-time benefit for the birth of a child | RUB 14,497.80 | RUB 15,512.65 (RUB 14,497.80 × 1.07) |

| Minimum monthly allowance for child care up to 1.5 years | RUB 2,718.34 (for the first child); RUB 5,436.67 (for the second and subsequent children). | RUB 2,908.62 (RUB 2,718.34 × 1.07) - for the first child; RUB 5,817.24 (RUB 5,436.67 × 1.07) - for the second and subsequent children. |

Child benefits from July 1, 2016

From July 1, 2016, the minimum wage increased to 7,500 rubles. Also see "", "". But did the increase in the minimum wage affect the size child benefits from July 1? Let's look at this in more detail.

Maternity benefit from July 1

The new minimum wage has affected the calculation of maternity benefits in the following cases:

- if in billing period there were no payments or their amount was small;

- if the insurance period is less than six months.

Billing period– these are the two calendar years preceding the start of the maternity leave (from January 1 to December 31). Accordingly, if a woman goes on maternity leave, say, in July 2016, then the billing period will be 2014 and 2015.

There is no or little earnings in the billing period

Let us remind you that an employee who is assigned maternity benefits can contact the accounting department to replace one or two years of the billing period with other years (if there is no earnings in the billing period or it is very small). The accountant should replace the years while simultaneously meeting 3 conditions:

- a woman wants to change the years in which she was on maternity leave or parental leave;

- the years selected for replacement precede the billing period (letter of the Ministry of Labor of Russia dated August 3, 2015 No. 17-1/OOG-1105);

- As a result of changing years, the benefit amount will become larger.

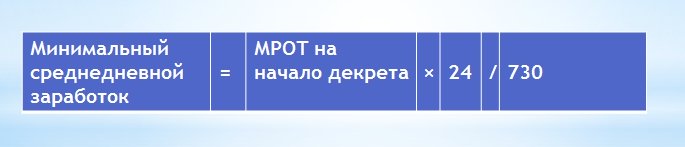

But if there is no right to replace years, then the accountant will need to calculate maternity benefits from the minimum wage. In such a situation, you need to determine the minimum average daily earnings using the following formula:

From July 1, 2016, the minimum wage is 7,500 rubles. Accordingly, from July 1, 2016, the minimum average daily earnings is 246.58 rubles. (RUB 7,500 × 24 months) / 730. Use this value. Let's give an example calculation of child benefits from July 1.

Calculation example.

A.S. Petrova goes on maternity leave from July 8, 2016. The billing period is from January 1, 2014 to December 31, 2015. There is no earnings during the billing period. There is no right to change the years of the calculation period. Insurance experience - 8 months. The regional coefficient does not apply.

The minimum average daily earnings is 246.58 rubles. (RUB 7,500 × 24 months) / 730. Daily allowance - RUB 246.58. (RUB 246.58 × 100%). As a result, the amount of A.S.’s benefit Petrova for 140 calendar days of maternity leave, calculated from the minimum wage, will be 34,521.20 rubles. (RUB 246.58 × 140 days).

Until July 1, 2016, the minimum average daily salary from the minimum wage of 6,204 rubles was 203.97 rubles (6,204 rubles × 24 months / 730). Accordingly, for 140 days of maternity leave the minimum benefit was less and amounted to 28,555.40 rubles. (RUB 203.97 × 140 days). That is, from July 1, 2016, the minimum maternity benefit increased by 5,965.80 rubles (34,521.20 rubles – 28,555.40 rubles).

Please keep in mind that when multiple pregnancy, complicated childbirth, as well as at the birth of two or more children, the duration of maternity leave increases to 194 and 156 days, respectively (Part 1 of Article 255 of the Labor Code of the Russian Federation).

Accordingly, the amount of benefits increases proportionally:

Less than six months experience

At the start of maternity leave, a woman’s length of service may be less than six months. This happens, for example, when this is a woman’s first job. Then maternity leave for a full calendar month should not exceed the minimum wage (Part 3, Article 11 of Federal Law No. 255-FZ of December 29, 2006). In areas with regional coefficients - in an amount not exceeding the minimum wage, taking into account such coefficients.

When calculating benefits for less than six months of experience, the accountant should use the minimum wage valid for the month maternity leave. That is, if the vacation began in June 2016 and ended in October, then in order to limit the amount of benefits in June, you need to rely on the minimum wage in the amount of 6,204 rubles, and in July, August, September and October - 7,500 rubles.

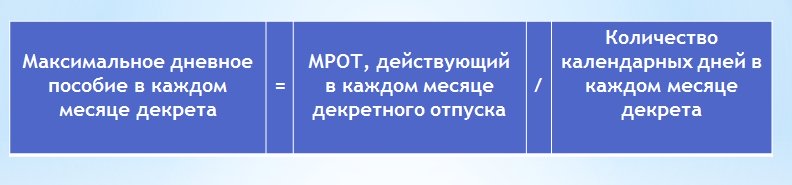

The accountant should calculate the maximum daily allowance for each month using the following formula:

If we are talking, for example, about maternity leave in July, then the maximum daily allowance in this month will be 241.94 (7500 rubles / 31 days), since July 2016 has 31 calendar days. In this case, the minimum wage should be multiplied by the regional coefficient if it is applied in the region (part 3 of article 11 of the Federal Law of December 29, 2006 No. 255-FZ).

If the experience is less than 6 months, the accountant needs to compare two daily benefits: which is calculated based on the actual salary and the minimum wage. And choose a smaller value. Let's explain with an example.

A.S. Petrova has been going on maternity leave since June 8, 2016. It will end on November 25, 2016 (140 days total). In the billing period from January 1, 2014 to December 31, 2015, she has no income. Insurance experience - 5 months and 1 day. The regional coefficient does not apply.

Let's determine the average daily earnings from the minimum wage, which is applied at the beginning of maternity leave (that is, in July). The average daily earnings will be 246.58 rubles. (RUB 7,500 × 24 months) / 730. Accordingly, the daily allowance will be RUB 246.58. (RUB 246.58 × 100%).

The maximum daily benefit, depending on the number of calendar days, is as follows:

- July, August and October - 241.94 rubles. (RUB 7,500 / 31 calendar days);

- September and November - 250 rub. (7500 rubles / 30 calendar days).

Now let’s compare the amount of the daily allowance from the minimum wage with the maximum daily allowance for each month of maternity leave:

- RUR 246.58 > RUB 241.94;

- RUR 246.58< 250 руб.

It turns out that for July, August and October the accountant must calculate the benefit from the maximum, and not the actual earnings, that is, from 241.94 rubles (in these months the maternity leave period is 86 days). But for September and November (54 days of maternity leave), the average daily earnings (246.58 rubles) should be taken for calculation, since it does not exceed the maximum daily benefit. As a result, the total amount of the benefit will be 34,122.16 rubles (241.94 rubles × 86 days) + (246.58 × 54 days)

Child care benefit from July 1

The employer must pay child care benefits to the employee monthly in an amount equal to 40% of average earnings, but not less minimum size(Clause 1, Article 11.2 of the Federal Law of December 29, 2006 No. 255-FZ). As we have already said, from February 1, 2016, the minimum child care benefits are as follows (Resolution of the Government of the Russian Federation dated January 28, 2016 No. 42):

- 2908.62 rubles – for the first child;

- 5817.24 rubles - for the second and subsequent children.

However, due to the increase in the minimum wage, the minimum size child benefit from July 1, 2016 Should not be used on the first child. The fact is that until July 1, the minimum wage had no effect on the minimum child benefit. When the minimum wage was 6,204 rubles, it was pointless to calculate benefits from this amount - it turned out to be less than 2,908.62 rubles. (6204 × 40% = 2481.60).

However, the situation has changed. The minimum amount of child benefit for caring for the first child from July 1, 2016 is 3,000 rubles. (RUB 7,500 × 40%). However, you can use the new value only if the vacation began on July 1, 2016 or later. The “minimum wage” for caring for the second and subsequent children has not changed. It remains 5817.24 rubles even after July 1.

The increase in the minimum wage did not affect the maximum amount of monthly child care benefits. We will indicate its size below.

Recalculation of benefits

If the right to leave to care for the first child arose before July 1 and the accountant calculated the minimum benefit (2908.62 rubles), then no recalculation should be made. However, if the vacation began on July 1 or later, then the woman is entitled to 3,000 rubles for each month. Accordingly, if you paid the woman less, then you need to recalculate and pay extra.

You will also need to review and pay additional maternity benefits if, after July 1, 2016, you assigned them without taking into account the increased minimum wage in the cases described above (no earnings in the billing period or less than six months of service).

Amount of child benefits from July 1: table

So, we have shown with examples how changes in the minimum wage affected the amount of child benefits from July 1, 2016. Now we will summarize the final values in a single table so that you can see which ones have changed amount of child benefits from July 1.

| Child benefits | ||

| Benefit | from February 1, 2016 | from July 1, 2016 |

| Benefit for registration in early pregnancy | RUB 581.73 | RUB 581.73 |

| One-time benefit for the birth of a child | RUB 15,512.65 | RUB 15,512.65 |

| Minimum amount of benefit for child care up to 1.5 years | care for the first child - 2908.62 rubles; | care for the first child - 3,000 rubles; care for the second child 5817.24 rubles. |

| Maximum amount of benefit for child care up to 1.5 years | RUB 21,554.82 | RUB 21,554.82 |

| Minimum amount of maternity benefit | 140 days - 28,555.40 rubles; 194 days - 39,569.62 rubles; 156 days - RUB 31,818.87. | 140 days - 34,521.20 rubles; 194 days - 47,835.62 rubles; 156 days - 38,465.75 rub. |

| Maximum amount of maternity benefit | 140 days - 248,164 rubles; 194 days - 343,884.4 rubles; 156 days - 276,525.6 rubles. | 140 days - 248,164 rubles; 194 days - 343,884.4 rubles; 156 days - 276,525.6 rubles. |

Benefits for Chernobyl survivors: what has changed

Let us separately dwell on the issue of Chernobyl benefits. So, the law provides benefits for children of Chernobyl victims. In particular, childcare benefits for Chernobyl victims is paid in an increased (double) amount. From July 1, 2016, provisions regarding the specifics of assigning child care benefits to persons exposed to radiation as a result of the Chernobyl nuclear power plant disaster, which are specified in paragraphs 7 - 9 of Part 1 of Art. 13 of the Law of the Russian Federation of May 15, 1991 No. 1244-1. Benefits for Chernobyl victims in 2016, will still rely on:

- citizens permanently residing (working) in the territory of the residence zone with the right to resettle;

- citizens permanently residing (working) in the territory of the residence zone with a preferential socio-economic status;

- citizens permanently residing (working) in the resettlement zone before their relocation to other areas.

Childcare benefits for children up to 1.5 and up to 3 years old for Chernobyl victims were previously assigned at double the amount. However, from July 1, 2016, monthly child care benefits will be provided to these persons in accordance with the general procedure. From July 1, they are guaranteed a monthly payment for each child in the following amounts:

- until the child reaches the age of one and a half years - in the amount of 3,000 rubles;

- at the age of one and a half to three years - in the amount of 6,000 rubles.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

This post has 1 comment.

Please enable JavaScript to view the comments. Contents of the article:For non-working mothers, it is very important to receive child care benefits, especially if there are two or more of them in the family. In this article we will look at the intricacies of receiving benefits for a second child, its size and combination with other payments. In addition, another working family member with a high salary can receive such benefits, and he does not have to leave work, he just needs to reduce his working hours.

What is the monthly benefit amount for the second child?

When calculating benefits for caring for a child up to 1.5 years old, according to the current legislation of the Russian Federation, the number of children and the order of their birth or adoption are taken into account. Since 02/01/2016, the amount of the minimum monthly benefit for the second child was indexed to 7 percent, and since February 2017, the indexation was 5.4%. Today, the mother will receive at least 6,131 rubles 37 kopecks for her second child and subsequent ones, and 3,065 rubles 69 kopecks for the first. It should be taken into account that maximum size benefits should not exceed 23,089 rubles 03 kopecks.

You need to know that if the mother was deprived of parental rights in relation to the first baby, then the second child will be legally considered the first and the allowance for caring for him up to 1.5 years will be calculated as for the first, that is, the mother will receive at least 3065 rubles 69 kopecks, and not 6131 rubles 37 kopecks. This provision is enshrined in the laws of the Russian Federation, that is, the calculation and payment of monthly benefits for a child under 1.5 years old is carried out in accordance with the order of the Ministry of Health and Social Development of the Russian Federation No. 1012n dated December 23, 2009 “On approval of the Procedure and conditions for the appointment and payment state benefits citizens with children."

How is the benefit for a second child calculated?

The calculation of payment of benefits for caring for a second child is carried out at the place of employment (working women pay contributions to the Social Insurance Fund) or in the Social Insurance Fund. Funds are allocated to the Social Insurance Fund in both cases. The payment for both children depends on the average monthly salary and is 40% of it.

The average salary is taken for the last two calendar years, but they can be replaced if maternity leave or leave to care for the first child coincides with them.

The calculation formula involves not only the amount of maternal wages, but also a number of other factors. It looks like this:

P = NW x 30.4 x 0.4, Where:

P - the amount of the monthly benefit;

SZ - average daily wage, equal to the amount of income 24 months before the start of parental leave, divided by 730 (average number of days for 2 years). From 730, working days missed due to temporary disability are taken away;

30.4 - average number of days per month, based on annual calculations (365:12 = 30.4);

0.4 - 40 percent of wages.

If the amount of benefits for children under 1.5 years of age exceeds 100% of the mother’s average salary, she will receive a payment in the maximum amount provided.

If the amount of the monthly allowance for the second child calculated using the formula is less than the permissible minimum established by law, then the woman will receive 6131 rubles 37 kopecks, that is, no less than the established minimum for the second child.

Calculated once social benefit from the employer or the Social Insurance Fund is not subject to recalculation until the woman renews it labor activity or until payments are completed when the child turns 1.5 years old. Therefore, if your salary has increased, the best solution would be to interrupt your vacation and go to work for one day, and then go on maternity leave again with an increased benefit. The features of early exit from maternity leave are described in detail on our website.

Calculator maternity payments allows you to quickly and easily calculate the amount of sick leave for maternity leave and childcare benefits for children up to 1.5 years old. After entering the data correctly, you will get accurate and correct results.

How to use a calculator to calculate sick leave for pregnancy and childbirth

- Select the type of payments you want to calculate (“Sick leave for pregnancy and childbirth”).

- Enter the vacation period and select the billing years.

- Check the boxes if the regional coefficient is taken into account, if the employee works part-time, or if her insurance period is less than six months.

How to use a calculator to calculate child care benefits for children up to 1.5 years old

- Select the type of payment you want to calculate (“Child care benefit up to 1 year”).

- Choose which child it is - the first or second (or more).

- Select your child's date of birth.

- Select calculation years.

- Check the box if there were periods of exclusion.

- Fill out the summary table to calculate your monthly earnings.

- Check the boxes if the regional coefficient is taken into account.

- Click "Results" to get the result.

A monthly allowance for child care up to 1.5 years, unlike maternity benefits, is paid absolutely all citizens: employed, laid off, unemployed, students. Depending on the status of the recipient, a monthly allowance is assigned and paid either at work in the amount of 40% of average earnings, or in the authorities social protection population in a fixed minimum or maximum amount, subject to annual indexation.

Allowance for child care up to 1.5 years (non-working) for the unemployed and students

For persons living in areas and localities where regional wage coefficients are established, the amount minimum benefit determined using these coefficients.

Care payments are assigned upon application to social protection bodies (SSPA) at the place of residence or actual residence.

Monthly payments for child care are assigned in the case of their failure to receive unemployment benefits.

For non-working persons, a monthly child care allowance is paid from the day of his birth until the child reaches the age of 1.5 years.

For full-time students enrolled in educational organizations care allowance is granted or from the day of birth of the child on the day he turns one and a half years old (if the child’s mother does not take maternity leave), or from the day following the end of maternity leave, until the day the child turns 1.5 years old - if the mother takes maternity leave.

Childcare benefits for working children under 1.5 years of age

Unlike maternity benefits, which are paid only the mother of the child, care allowance for up to 1.5 years can also be received by other relatives: father, grandmother, grandfather, aunt, etc., who actually care for the child. If several relatives are caring for a child at the same time, then the right to receive a monthly child care allowance is given to one person.

Amount of benefit for child care up to 1.5 years in 2017

In 2017, the minimum amount of benefits for child care up to 1.5 years until February 1, 2017 is:

- behind the first - RUB 2,908.62;

- for the second and subsequent children - RUB 5,817.24.

The minimum child care benefit in 2017, calculated from the minimum wage, is 3000 rubles per month(RUB 7,500 x 40%), which is slightly more than the legal minimum monthly allowance for caring for the first child of RUB 2,908.62. This benefit is paid only to an insured woman who has worked for less than two years with low wages.

The maximum care allowance for up to 1.5 years for persons dismissed due to the liquidation of organizations cannot be higher maximum amount established before February 1, 2017 – 11,634.50 rubles.

In Moscow, women dismissed due to liquidation are additionally paid a monthly compensation payment for children under 1.5 years of age. The payment amount from January 1, 2016 is 1,500 rubles.

Minimum benefits (for individual entrepreneurs, unemployed people, students, low-wage workers and/or working for less than two years) and maximum (for laid-off workers) subject to annual indexation.

Maximum benefit amount care in 2017 is RUB 23,120.66. The maximum benefit is calculated based on the maximum base for calculating insurance premiums in 2015 (670,000) and 2016 (718,000) = (670,000+718,000)/730*30.4*40%= 23,120.66.

Regional coefficient applies only to minimum benefits child care. As for the maximum benefit, it is the same for the entire territory Russian Federation and is not subject to increase by the size of the regional coefficient.

Calculated benefits (40% of earnings) are not subject to indexation. Therefore, if a woman in 2016 received maximum benefit, and earnings allow you to receive benefits in the maximum amount of 2017, then such benefits cannot be recalculated.

In the case of caring for two or more children before they reach the age of one and a half years, the amount of the monthly child care allowance sums up. In this case, the total amount of the benefit cannot exceed 100 percent of average earnings, but cannot be less than the total minimum amount of this benefit.

Along with the allowance for the period of child care, a monthly compensation in the amount of 50 rubles is assigned, which is paid from the beginning of parental leave until the child turns 3 years old, if the mother does not work (did not return to work and is on maternity leave).

Calculation of care allowance for up to 1.5 years in 2017

The care allowance is calculated based on the average earnings calculated for 2 calendar years preceding the year of parental leave, including during work (service, other activities) with another employer(s).

When calculating childcare benefits for a child up to 1.5 years old in 2017, it is necessary to divide the amount of earnings for 2 years by the number of calendar days in this period (calendar days for 2015 and 2016 are 731), excluding calendar days falling on excluded periods(periods of temporary disability, maternity leave, parental leave; period of release from work with preservation (in whole or in part) of earnings, if for it insurance premiums NOT accrued). Leave without pay (leave at your own expense) is NOT excluded from the calculation.

Benefit calculation algorithm for women who go on maternity leave for up to 1.5 years of age in 2017: SDZ=(SZ_2015 + SZ_2016) / (731 minus excluded calendar days) * 30.4*40%.

The possibility of replacing years when calculating care benefits, as well as determining the average daily earnings for care benefits does not differ from the definition of SDZ when calculating maternity benefits ().

If maternity leave begins in 2017, then 2015 and 2016 will be included in the calculation. If in the billing period a woman was on maternity leave and (or) parental leave, then it can replace one or two calendar years for calculating the care allowance for earlier (immediately preceding) years if this leads to an increase in the benefit amount.

In this case, the average earnings, on the basis of which maternity benefits are calculated, are taken into account for each calendar year in an amount not exceeding the established maximum base for calculating insurance contributions to the Social Insurance Fund for the corresponding calendar year:

- for all previous years, until 2011, this value is 415,000 rubles.

- for 2011 – 463 000 rubles

- for 2012 – 512 000 rubles

- for 2013 – 568 000 rubles

- for 2014 – 624 000 rubles

- for 2015 – 670 000 rubles

- for 2016 – 718 000 rubles

SDZ - average daily earnings (if a woman replaced the calculation years with earlier ones) cannot exceed the amount calculated for 2 calendar years before the year of leaving on maternity leave, that is, in 2017 no more than 1901.37 rubles. Therefore, the maximum amount of care benefits in 2017 (even when replacing years with earlier ones in a “maternity to maternity” situation) may be RUB 23,120.66, but not higher.

Duration of assignment of care allowance

A monthly child care allowance is assigned if the application is made no later than six months from the date the child reaches the age of one and a half years. When applying for monthly child care benefits after a six-month period, a decision on the assignment of benefits is made territorial body the insurer if there are valid reasons for missing the deadline for applying for benefits. Such reasons are: long-term temporary disability of the insured person due to illness or injury lasting more than six months; moving to a place of residence in another locality, change of place of residence; damage to health or death of a close relative; other reasons recognized as valid in judicial procedure, when insured persons apply to court (order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2007 No. 74).

The benefit is paid on paydays. The decision to assign a monthly child care benefit is made within 10 days from the date of filing the application for the grant with all the necessary documents.

Documents for granting benefits

To receive child care benefits for children up to 1.5 years old at the place of work, you must submit the following documents:

- birth certificate of the child being cared for, as well as certificates of previous children and copies of these documents;

- a certificate from the other parent’s place of work stating that he does not receive this benefit;

- if necessary - an application to replace the years with earlier ones;

- if necessary, a certificate from the previous employer about the amount of wages for calculating benefits (needed if the applicant has changed jobs during the previous two years).

If a woman is a part-time worker, then it is additionally necessary to provide a certificate stating that benefits were not assigned or paid at another place of work.

Calculation of benefits when working for several employers

If the insured person, at the time of parental leave, works for several policyholders and was employed by the same policyholders in the 2 previous calendar years, the monthly child care benefit is assigned by the policyholder one place of work at the choice of the insured person, while the benefit is calculated based on the average earnings during the period of work for the policyholder who assigns and pays the corresponding benefit.

In this case, when calculating the benefit, the average earnings during work for another employer are taken into account for the period preceding the period of work for the insurer assigning and paying the specified benefit. That is, if at the time of maternity leave a woman does NOT work part-time (quits), then this earnings received from a part-time worker will be taken into account when calculating the care allowance.

If, at the time of care leave, the woman continues to have an employment relationship with the employer, in addition to her main job, then earnings will not be taken into account when calculating the care allowance, despite the fact that insurance premiums have also been calculated and paid from it.

The right to a monthly child care allowance is retained if the person on parental leave works part-time or at home and continues to care for the child.

© Copyright: site

Any copying of material without consent is prohibited.