A large family cannot live without a personal car. Anyone who has at least once tried to drag a stroller up the stairs in the subway or on a tram will understand. Therefore, it is not surprising that the majority of not even large families, but rather ordinary families, try to acquire personal vehicles in the first years after the birth of a child.

However, the car has one very significant drawback - it is expensive. Expensive to buy, expensive to maintain and expensive to pay taxes. What to do? Unfortunately, you will have to come to terms with the first two problems, but with regard to the transport tax for large families There are some concessions. Which ones exactly and where? Now we'll tell you.

Tax benefits - for whom?

Do large families pay transport tax? In a number of constituent entities of the Federation, families with 3 or more children are exempt from paying vehicle tax. However, this is far from universal practice. In many regions (Omsk Region, Krasnoyarsk Territory, Republic of Tatarstan, Republic of Bashkortostan, etc.) there are no transport tax benefits for large families due to low budget occupancy. Since transport tax refers to taxes credited to regional budgets, the right to provide benefits rests entirely with the government of the relevant regions.

However, even where benefits are provided, not everything is so simple. The most serious problem that exists in Russia today is the lack of an unambiguous and clear definition of a large family. Although the vast majority of regions assign the status of a large family to persons raising at least three children (natural or adopted), such unity in legislation is not observed. Even in those regions where a classic family with two adults and three children is called a large family, some of the benefits may not apply to them.

A striking example is St. Petersburg. So according to clause 2. Art. 1 of the Social Code of St. Petersburg, a family with three or more minors is recognized as having many children. In accordance with the Code, large families receive additional support measures in the form of one-time and monthly payments, compensation for utility costs, etc. At the same time, the Law of St. Petersburg “On Transport Tax” does not provide benefits to families with three children. According to it, large families with at least four children in their care may not pay transport tax. And I must say, this practice is found everywhere.

Of course, there is no question of any justice in this matter. Until the status of a large family is consolidated at the national level, it is unlikely to expect changes at the regional level. Until this time, we recommend that you individually clarify your right to benefits in regional office Federal Tax Service.

If benefits are not provided in your region, but you really want to get them, you can use a trick and register the vehicle in another region. According to the law, tax is paid in the area where the vehicle is registered, and not where it is actually used. However, please note: this method is only suitable for those who are buying a new car or making a transaction under a contract, and not by proxy.

Depends on region

So, in which regions of the Federation can large families count on exemption from paying transport tax in 2015?

In Moscow and the Moscow region, one adult in a large family for one vehicle is exempt from paying the tax. Although, as we have already found out, completely different families can be recognized as having many children, in in this case- this means a family with 3 or more children.

At the same time, in the Moscow Region, benefits apply only to specific types of vehicles:

- automobile;

- motorcycle or scooter;

- bus;

- tractor.

In the northern capital, families with 4 children have a benefit. The benefit is expressed in the opportunity not to pay tax for one vehicle with a capacity of up to 150 hp. By the way, it is inexplicable, but it is a fact - in the Leningrad region such restrictions do not apply: here privileges extend to “ordinary large families” and to any vehicle of their choice.

In the Novosibirsk region (regional law No. 69-OZ of November 22, 2002) there are no special benefits for large families, but individual owners:

- passenger cars, motorcycles, scooters and self-propelled vehicles pay a tax in the amount = 1/5 of the statutory rate;

- snowmobiles, boats, yachts and jet skis - in the amount of 1/2 of the statutory rate;

In the Nizhny Novgorod region (regional law No. 71-Z dated November 28, 2002) father of many children or mother of many children can take advantage of benefits in relation to:

- passenger cars with power up to 150 hp;

- motorcycle/motor scooter with a power of 36 hp;

- motor boat with power up to 30 hp

In the Republic of Sakha (Republic Law No. 1231 of November 7, 2013), individuals who own Russian passenger cars with a capacity of up to 150 hp are exempt from paying the tax.

In the Volgograd region (regional law No. 750-OD dated November 11, 2002), a parent with many children may not pay tax for one personal car, motorcycle or stroller.

In the Samara region (regional law No. 86-GD dated November 6, 2002), from March 5, 2009, all individuals are exempt from payments for vehicles with a capacity of up to 80 hp, manufactured before 1991.

How to get a benefit?

The procedure and timing for using tax benefits for large families is determined by regional legislation. However, we can give you some general advice.

In most cases, the right to benefits appears from the moment the status of a large family is obtained, that is, from the date of birth of the next child (third and further). However, this does not mean that you need to run to the Federal Tax Service the next day after being discharged from the maternity hospital.

To provide benefits, you must document your right to receive them, i.e. provide birth certificates for all children + identification card of the recipient of the benefit + documents for the vehicle. Documents are provided no later than the end of the tax period.

At the beginning of 2014 we became large family. The state promises mountains of benefits to large families. But my wife and I don’t believe in free benefits, especially from the state - we rely only on ourselves and our own strengths. However, the opportunity to reduce taxes for large families is good and this is the first thing to take advantage of. In addition, not many large families who are entitled to these benefits by law know about this.

The whole epic began with the receipt of a certificate of large families. It wasn't easy for us. But that’s not about that now. Now I want to talk about the part related to automotive topics. One of the benefits for large families is exemption from transport tax one vehicle per family. If there are more vehicles (a baby stroller does not count), you will have to choose one of them.

Another nice bonus with which you can “soar” above other Muscovites (if you are registered in Moscow) is free parking for a large family. All this can be done in one trip to the tax office. Eh, the flashing lights just don’t show up yet...

Exemption from transport tax

To be exempt from transport tax, a large family must submit the following documents to the tax office at the place of registration:

- certificate of a large family;

- application in free form;

- original passports of both parents;

- an extract from the house register or a financial and personal account for the apartment (they are required, but we haven’t really looked at it. You need to get it from the MFC);

- vehicle passport (PTS);

- vehicle registration certificate (VRC);

- Taxpayer Identification Number (TIN) of the owner of the vehicle (they can independently find out at your registration address).

We submitted documents to the Inspectorate of the Federal Tax Service of Russia No. 13 for Moscow, which is located at the Kurskaya metro station. The review period is 10 working days. But even after tax exemption, letters of “happiness” from the tax office will still continue to arrive. But the accounts in them will be zero.

Free parking for large families

When submitting documents for exemption from transport tax, a large family registered in Moscow should also submit documents for free parking. Free parking is available for the same car that is exempt from transport tax. That is, if you have two cars, then you can exempt one from tax, but you won’t be able to park the other for free. Besides, Free parking can be arranged only if you are exempt from transport tax. The package of documents is the same as for exemption from transport tax. A statement is added, also in a free form. The review period is 10 working days. After we submitted the documents, two weeks later they called us and asked us to pick up a certificate of approval for a tax benefit.

You can also obtain a free parking permit through the MFC. But we did everything at the tax office in one visit.

As a result, you can now leave your car in paid zones with peace of mind. Automatic lockers will count your vehicle as a benefit. There is no need to do any further special actions. You don't need to take anything with you. Recording and comparison with the database occurs electronically.

Attention!

Two important points:

- Permission action suspended if there are three or more unpaid fines. Renewing it is still a hassle. No one really knows who to inform and when. I haven't personally encountered this yet. Therefore, if fines occur, pay promptly!

- A free parking permit for a large family is given for a year. Further, apparently, it needs to be extended. I don't understand this logic. Oh, come on, we live in Russia...

Worth keeping in mind

Regardless of belonging to a large family, Electric cars and motorcycles can park in paid parking zones for free.

There is an opinion that the benefits described above apply to low-income families. I refute this opinion. This is wrong. All families with the status of large families have the right to be exempt from transport tax.

Update dated September 6, 2015: Like me, you can apply for/extend parking benefits for families with many children through the website public services(http://pgu.mos.ru/).

Families with children find it difficult to live without a car. Especially when it comes to a large family. But buying and maintaining a car is not a cheap pleasure, so government assistance can be very helpful. For example, regional benefits for the payment of compulsory transport tax are a great help to large families. The specific subsidy figure varies in each locality, since the transport tax collected in the territory goes to the regional treasury.

Moreover, in each federal subject the status of a large family is assigned to citizens with a different number of children. The rules may apply to citizens with three or four children, so tax breaks should be dealt with on a case-by-case basis. In certain regions of the Federation there is no mention of such programs at all. This article contains information about administrative concessions for citizens with many children in the field of transport payments, rules and conditions for processing documents.

Transport taxes received from citizens replenish the local budget, so benefits are directly dependent on the situation in the federal subject. Three situations are possible: no benefits are provided, the tax is partially repaid in the specified percentage deduction, or the family is completely exempt from it. The order made by the local government may change depending on the situation, which should be monitored by those concerned.

Receiving material benefits, including transport tax for families with many children, requires an application. This means that citizens must independently declare their rights, otherwise they will have to pay taxes on a general basis. Since the country is home to millions of families with three or more children, their privileges are established by Article 31 of the Tax Code of the Russian Federation. Federal law does not say anything about reducing or canceling transport taxes for families with many children; you will need to contact local authorities on this issue.

By contacting your local branch of the Federal Tax Service, you can inquire about the state of affairs today. If the region provides a benefit, then employees will explain the timing of repayment of the reduced tax or its complete absence. If the family is on the preferential list, then you will need to write an application and thereby begin to receive support from the local government.

According to the law, the family has the right to regional benefits in accordance with Article 14 of the Tax Code of the Russian Federation. The fact that the taxation procedure is established by local authorities is reflected in Article 361 of the Tax Code, and the rules for obtaining tax breaks are listed in Article 372 of the Tax Code. If controversial situations arise with employees at the tax office, you can refer to the following articles of legislation.

In Moscow, tax exemption is provided for one vehicle for citizens with three children. In St. Petersburg, this opportunity is given to families with four children. In the Krasnodar Territory, Tatarstan, and Altai, transport tax is reduced by 50% of the full amount. In the Rostov and Nizhny Novgorod regions, tax penalties for families with three children have been completely abolished; the program applies to one car.

You can view the full list of federal entities that provide relief on deductions on the website of the Federal Migration Service. The conditions for obtaining transport benefits for large families are also indicated there.

Subtleties of providing benefits

Regardless of regional policy, local rules provide for mandatory conditions for obtaining tax breaks, namely:

- reduction or exemption from transport tax applies to one vehicle. The choice is made by the citizens themselves, the rest of the family participate in taxation on a general basis;

- in cases where citizens can receive exemption on various legal grounds, they independently choose the ones that are most acceptable to them. For example, you can get state support due to the disability of a family member, a larger benefit is chosen;

- tax breaks on transport tax do not apply to specific transport, such as snowmobiles, watercraft, etc.;

- if there is a replacement of vehicles, one car is deregistered, another is delivered in the same month, then the benefit applies only to one vehicle, for the second you will have to pay the full rate.

In addition to parents, adoptive parents and guardians can submit an application to the tax office if they have three or more children. The application is written according to a standard template provided by tax officials. The application can be written by one of the parents; there are no restrictions in this regard. To receive a tax benefit for transport tax You will need to attach the following information:

- applicant's passport;

- children's birth certificates;

- a certificate confirming the status of a large family;

- If in the region a tax benefit is provided only to low-income large families, then it is necessary to obtain a corresponding certificate from the social service.

The application can be submitted to the tax office by the parent's authorized representative. If the application contains controversial information, unreadable fragments or the submitted documents are overdue, then the parent will have to fill out the form again and provide an indisputable documentary basis. In this case, you will need official confirmation of authority, namely a notarized power of attorney. The text of the application itself must contain the personal data of the parent, the name of the Federal Tax Service and the passport details of the car for which tax exemption is required.

In large cities such as Moscow, large families are given another privilege related to transport. We are talking about a parking space for the car specified in the application. With full tax exemption provided for parents with many children in Moscow, you can simultaneously write an application for free parking. A standard form application is submitted based on the same package of documents. The right to use a parking space cannot be transferred to third parties, otherwise the benefit will be canceled.

The period for consideration of an application for parking is 10 days, after which the applicant is notified of the decision taken. Having received official permission, you no longer need to carry the document with you constantly. If the car number is automatically recorded, the information will be verified by the system and no fee will be charged. A free parking permit can be obtained separately from the vehicle tax exemption. Most in a simple way is an appeal to the MFC.

A parking permit is issued for a year, then it will have to be renewed in the same way. If there are three or more fines, the permit is canceled automatically and it will not be possible to restore it for the current year.

You must declare your right to government support once, then the benefit will be extended annually. If a family loses its status as a large family, that is, the children become adults, then the cancellation is carried out automatically. Starting this year, they will have to pay transport tax on a general basis, of which citizens are not notified in writing.

Participation in the program is terminated if the car is deregistered, in which case the issue of paying transport tax is completely removed. You can declare your rights if you missed the deadline, that is, retroactively for the last three years. Recalculation is done according to a standard application, the money is returned to the bank account of one of the parents.

Because local regulations vary, you should check your family benefits for yourself. This can be done by contacting the tax office in person or on the official portal of the regional Federal Tax Service. If the family is not provided with benefits, despite the existing grounds, then you can write a complaint to higher and supervisory authorities.

Disputes are resolved in judicial procedure, but usually the case does not come to court. If the family has the status of large and can participate in state program, then it is guaranteed an exemption or reduction in transport tax.

Will the car tax be abolished for families with many children?

It has many payment features. Some categories of citizens are allowed not to pay it. Should a large family pay transport tax?

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to know how to solve exactly your problem - contact the online consultant form on the right.

Or call us at number:

8 804 333 71 85 (Toll free)

It's fast and free!

Do such families pay TN?

Transport tax is entirely regulated by local authorities. Benefits for it are also established by the regional administration. In one region, a decision is made on full benefits for large families, another establishes a 50% benefit, and in a third there are no concessions at all. Information about benefits in a specific area can be obtained from your local tax office.

If there is a discount, it applies only to one car belonging to a large family. The difficulty is that there is no single definition of what kind of family is large.

- In Moscow, a large family is a family with 3 minor children.

- In St. Petersburg - with four children who have not reached adulthood.

- In the Voronezh region, benefits are given to families with 5 young children.

Restrictions also apply to the vehicle's power. In some regions, an engine of up to 250 horsepower is allowed to use the benefit; in others, only 100 horsepower is allowed.

Read below about benefits, cancellations and exemptions for large families in Moscow, Moscow and other regions.

The video below will tell you whether large families need to pay transport tax:

Transport tax benefits for large families

What are provided

In the following cities and regions, large families do not need to pay transport tax at all if the maximum vehicle power requirement is met.

- In Moscow and the region, large families are not subject to transport tax for one car with a capacity of no more than 250 hp.

- Volgograd, Altai Territory, Kursk, Kurgan. Here the benefit applies to one car of large families, which is no more powerful than 100 hp.

- Kaluga, Crimea - power up to 200 hp is allowed for benefits.

- Benefit for large families for 1 car up to 150 hp. give in the Kemerovo, Nizhny Novgorod regions, in Yekaterinburg and the region.

The following regions and cities provide some relief for large families in paying transport tax.

- In St. Petersburg, families with 4 or more children pay half of the transport tax

- In Bryansk, a 50% benefit, regardless of the car’s power, is provided to large families if they are recognized as low-income.

- In Murmansk, the transport tax for large families is 10%.

Discounts for large families are also given in other regions of the country. You can find out exactly this information at the inspectorate at your place of residence.

But some regions do not provide any concessions for families with a large number of children.

- Novgorod, Krasnodar region, Komi, Karelia, Adygea.

- Magadan, Kostroma, Ingushetia, Vladimir, Astrakhan.

- Mordovia, Karachay-Cherkessia, Dagestan, Kamchatka.

- Arkhangelsk, Buryatia, Vologda, Bashkortostan.

Read below about applying for transport tax benefits for large families.

This video will tell you about transport tax benefits for large families in the Moscow region:

How to get

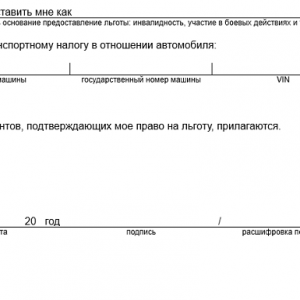

The benefit is provided after it has been declared. That is, in order to take advantage of the benefit, you need to write an application about the right to it to the local tax office. The application can be written in free form. But in it they indicate their Federal Tax Service number, passport information, write information about the vehicle that will receive benefits and describe a document that confirms having many children. You can download a sample application.

Application for transport tax benefits for large families

Application for transport tax benefits for large families - 1

Application for transport tax benefits for large families - 2

The following documents are attached along with the application.

- Document confirming having many children (certificate or certificate).

- Birth certificates of children.

The package of documents will be reviewed. If everything corresponds, then the benefit can be used with next month. When one of the children is already 16 years old, but is studying full-time, a certificate from the educational institution will be required.

A car is a means of transportation. For one person or a small family. For a large family, this means personal transport, a school bus, a courier, etc. The birth of a child (even one) pushes many to buy a car, because with it it is much more convenient to travel to various pharmacies, clinics, kindergartens, schools and other institutions that accompany small family members.

Of course, a car is not a cheap thing. The purchase has a significant impact on the family budget, unless you are an oligarch. Maintenance and maintenance also costs a pretty penny. Don't forget about tax payments. Transport tax is one of the integral components of a car. For families falling under the status of large families, there are certain tax breaks.

Transport tax relief

According to Government recommendations Russian Federation, large families with more than three dependents (children) in some regions receive benefits. Not all regional chapters follow these recommendations. For example, in the Omsk Region or Krasnoyarsk Territory, these benefits are not established - payments are an integral part of the local budget. And since the transport tax remains directly in the local budget, the right to distribute benefits for its payment rests with the local government.

Many regional authorities have still not decided on the specifics regarding the concept of “large family”. The classic option is a family with two parents and three or more of their own or adopted children. Benefits for such families vary depending on where they live. This is one of the hotly debated issues regarding regional policies.

For example, in St. Petersburg, a family with many children is considered to be in the classical sense, that is, two parents with three or more children. According to the city's social rules, they receive one-time or monthly cash benefits, compensation for utilities, and the like. If we take into account the transport tax, the relief does not fully apply to these families.

Only families with four or more dependents are exempt. This is practiced not only in St. Petersburg and its environs, but also in other regions of the country.

The question arises about objectivity in relation to large families and the extension of benefits to such families. Until a uniform status is adopted everywhere by law, regional authorities will at their own discretion distribute certain benefits. Therefore, it is best to clarify on the spot what benefits you can personally take advantage of if your family is applying for the status of “large”.

There is one solution for those families who do not qualify for benefits. If you register a vehicle in another region (where benefits are provided), then taxation will occur according to the rules of the “place of registration” of the car. But this option is only good for new cars.

Difference in regional policies

Let's try to find out in detail which regions of the Russian Federation have tax breaks regarding transport for large families.

In the capital and region, according to current laws, tax benefits Only one parent can use it. The Moscow authorities assign the status of a large family to families that have three or more children. Tax benefits are not provided for all vehicles, but only for buses, cars, motor vehicles or tractor units.

In St. Petersburg, as we already know, a large family receives rights to benefits if the number of children starts from four people. A vehicle that is eligible for benefits must have no more power than 150 horsepower.

The situation is different in the Leningrad region. A family is considered to have many children in the classic scenario - 2 adults + three children. Almost any type of transport that falls under the exemption.

In the Volgograd region, one of the parents has the right not to pay tax. In this case, we consider cars or motor vehicles. The benefits are specified in the local legislative document number 750-OD.

The Novosibirsk region completely abandoned. However, according to Law No. 69-OZ, adopted on November 22, 2002, There are some concessions:

- half of the tax amount established by local legislation is paid by the owners of yachts, snowmobiles, jet skis, and boats;

- A fifth of the total tax is paid by the owners of passenger vehicles, self-propelled vehicles, and motor vehicles.

In the Republic of Sakha, citizens who own vehicles with a power of no more than 150 l/s are legally exempt from transport taxation. This is written in law No. 1231, adopted on November 7, 2013.

Any of the two parents of a large family living in the Nizhny Novgorod region, according to the legislative act adopted on November 28, 2002 under number 71-Z, can receive a benefit.

Vehicles affected by the mitigation are as follows:

- a passenger car whose power does not exceed 150 l/s;

- motor boat, power up to 30 l/s;

- motor vehicles whose power does not exceed 36 l/s.

On November 6, 2002, the Samara region adopted Law No. 86-GD, according to which owners of vehicles manufactured before 1991 and whose power does not exceed 80 horsepower are exempt from vehicle tax.

How to take advantage of the benefits?

The nuances regarding the receipt of benefits and their validity period are determined in local legislation. There are several general provisions.

You can take advantage of tax benefits immediately upon the birth of your third child. It is then that the family receives the status of “large”.

Before the end of the tax payment period, you must provide documents for the car, identification documents of the owner of the vehicle, and birth certificates of all existing children at your place of residence to confirm your status.