At the birth of a child, the state pays one of the parents, which is established by separate regulations.

But to receive it, you must provide a certificate that the second spouse has not received such an amount and will not receive it.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

(Moscow)

(Saint Petersburg)

(Regions)

It's fast and for free!

Purpose

A certificate of non-receipt of a one-time benefit is needed by one of the parents in order to receive one-time cash assistance for a newborn, regardless of where the payment will be received: at the place labor activity, or in organs social protection.

This document confirms that financial assistance will be received only once, since the parent who received it does not apply for a cash payment at his place of work.

This document confirms that financial assistance will be received only once, since the parent who received it does not apply for a cash payment at his place of work.

The certificate is provided to the accounting department of the organization that will pay the benefit or to the inspector of social security authorities when filing an application for state support.

At inspection by FSS inspectors The presence of this document is checked.

Failure to submit it may be grounds for refusal to reimburse the amount of money paid. Also, in the absence, the employer or social security authority has the right to refuse to receive financial assistance to one of the spouses.

Receipt procedure

A certificate of non-receipt of benefits must be received by the parent who will not receive this amount of money.

It is issued at his place of work usually the accounting or human resources department.

This document can be received by any of the parents, not just the mother. This means that both the father and mother of the child can receive financial assistance.

This document can be received by any of the parents, not just the mother. This means that both the father and mother of the child can receive financial assistance.

If the spouse who will not receive benefits is, then he receives a certificate from the social security authority at his place of residence, it will be similar to that issued by any other organization.

There is also a third option - when the spouse who does not claim to receive financial support is registered as an individual entrepreneur or is, that is, he will have to issue benefits to himself. Or write a certificate to yourself. In this case, the document must be issued by the social insurance authorities.

Non-receipt paper cash assistance per child not needed only in one case when the parent receiving the payment is the only one, as a rule, this is the case when there is a space in the “father” column.

To receive and provide the document, it does not matter whether the parents are officially registered spouses, the main thing is that both of them are indicated on the birth certificate.

During the registration process, the citizen (employee) must write a corresponding application containing a request to provide this document.

All certificates issued must be recorded in the outgoing correspondence book.

You can choose who will receive the benefit only if the parents of the newborn live together, otherwise, only the spouse with whom the child permanently lives can receive this amount.

The certificate is issued in writing on the letterhead of the organization that issued it.

The text is formatted in any form, but at the same time it contains a number of necessary information.

She must contain the following information:

Example text

Let us give a variant of an acceptable formulation.

“This certificate was issued to Nikiforovsky Alexey Valerievich, an electrician for the repair and maintenance of equipment, working since February 27, 2013, in that he did not receive and will not receive lump sum allowance by the birth of a child, Nikiforovsky Alexander Alekseevich, born on March 30, 207.

This certificate was issued at the place of request.”

The document in question is mandatory so that this payment can be received by the other parent. The preferred place for receiving financial assistance is the organization where one of the parents is employed; if both are unemployed, for any reason, then financial support will be received from social security, but it is still necessary to obtain the reviewed document.

For the rules for applying for cash assistance at the birth of a child through the State Services portal, see the following video:

Features of registration of benefits for the birth of children

To understand when and who needs to issue a certificate of non-receipt of benefits at the birth of a child, let’s first figure out how the benefits are received.

The birth benefit is issued in accordance with the regulations and is confirmed by the following documents:

- passport;

- child registration data (certificate from the registry office);

- information about the company (last place of work), work book.

If the mother is officially employed, she will only need a birth certificate for the baby, since her employer has the rest of the data. The process is accompanied by drawing up an application. If it is submitted at your own enterprise, the form can be free or in the order established by the employer, but with the content of general norms. If you fill it out at the FSS office, fill in the following fields:

- mother's data, registration, passport;

- marital status;

- characteristics of the child;

- date of dismissal;

- information about father's work;

- presence of minor children;

- date, surname of the specialist who accepted the application.

The procedure for drawing up a certificate of non-receipt of benefits

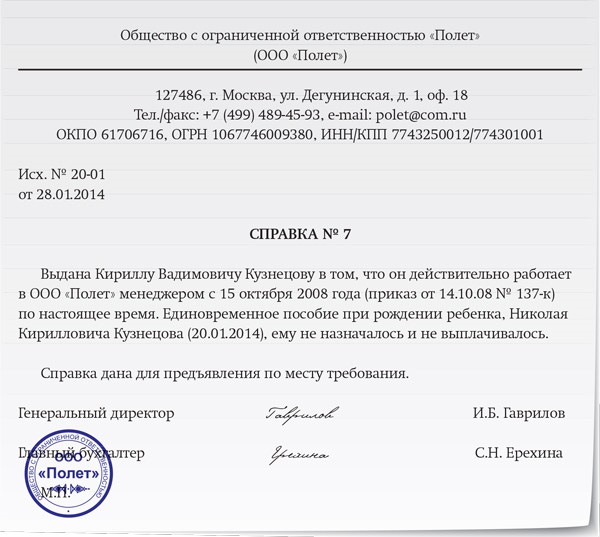

If the father is employed, he needs to request confirmation from his employer that there is no subsidy for the birth of children in his favor - this is a certificate of non-receipt of benefits. Depending on the structure of the enterprise, the paper is filled out by the immediate supervisor, director, chief accountant or other authorized person. The certificate must be on company letterhead indicating its official name, legal address, and bank details.

The following parameters should be specified in the help:

- The employee's surname, an indication of his position, the basis and the date from which he occupied it. The basis is the number of the order to take office.

- Absence of an order to provide leave for this person due to caring for a newborn.

- Absence of any accruals or payments to the employee for this reason.

- Purpose of the certificate. Usually, they indicate where required.

The certificate is signed by the chief accountant and general director, who act as guarantors of the specified data. The company seal is also affixed. The paper must contain the outgoing number and date and is registered with the company as an outgoing document according to internal records management.

Download a sample certificate of non-receipt of child benefits

Such a certificate is handed over to the father, who, together with the rest of the documents of the mother and child, sends it to the Social Insurance Fund or to the mother’s employer.

Who should issue a certificate from the place of work about non-receipt of benefits at the birth of a child - mother or father

Who should issue a certificate from the place of work about non-receipt of benefits at the birth of a child - mother or father If the father is unemployed, he also needs such a certificate of non-receipt of a lump sum benefit at birth. You need to get it from the social media office. protection according to the place of its registration. To do this, you should visit the office, voice your request and make a request. The employee will check that no such benefit has been accrued to the client and prepare a document in accordance with established norms and rules. This certificate is also given by the mother to her employer or the Social Insurance Fund when applying for benefits.

If there is a desire to apply for benefits on behalf of the father, the mother must request an identical document confirming non-receipt.

Features of receiving “children’s” benefits

A document confirming the non-receipt of payments by the second parent will also be required when subsequently applying for child care assistance. Such accruals are due for one and a half years and begin to be transferred immediately after the end of maternity leave. In addition to the certificate, other documents will be required:

- registration certificate from the registry office regarding the newborn;

- information about other children, if available;

- information about the mother’s last employer, if documents are submitted to the Social Insurance Fund, and the date of dismissal;

- certificate from educational institution if the mother is a full-time student;

- information about the amount and period of receipt of this benefit if the employing company was liquidated at the time when the mother was in maternity leave or “for care” (you should also obtain a copy of the order to go on such leave).

If the transfer of papers occurs to the FSS authority, you will need to have a passport. To register at the place of work, you don’t need a lot of information, since most of it is already known to the employer. In addition, an application must be filled out. The content is similar to that described above, and contains similar characteristics and parameters.

Having calculated the amount of the subsidy, the employer and the authorized body begins to transfer money to the mother’s account immediately after the end of maternity sick leave (leave).

Benefit legislation

A certificate of non-receipt of a one-time benefit at the birth of a child is drawn up and issued in accordance with the following regulatory documents:

Video - what benefits are provided during pregnancy and childbirth

A certificate of non-receipt of a one-time benefit is necessary to prevent fraudulent activities and comply with the law, to better understand this, watch the video.

In order for the certificate to be drawn up correctly, it must include the following information:

- number;

- date;

- place of registration;

- name of the form;

- text;

- manager's signature;

- seal of the organization, if available.

A certificate of employment is issued on the organization's letterhead, which must indicate the basic details of the organization and its contact information.

The executed document must be registered in the journal of outgoing documents, the assigned outgoing number is indicated on the certificate form.

The text should indicate that the certificate was given to a specific employee (his full name and place of work are written) and confirms the fact that the specified employee did not receive a lump sum benefit at the birth of a child, this payment was not accrued to him.

In order for the recipient of the document, if necessary, to contact the executor of the document and check his data, the full name of the contact person and his telephone number should be indicated.

An example of a certificate from the father’s place of work about non-receipt of benefits for the birth of a child

Ref. No. 2

September 17, 2015

Moscow

Reference

A certificate was given to Maxim Leonidovich Statov, who works at Panther LLC as a system administrator, stating that a lump sum benefit in connection with the birth of a child, the son of Timofey Maksimovich Statov, was not assigned or paid to him.

The certificate is given to be provided at the place of work of the child’s mother.

General manager Smirnova A.A.Smirnova

MP

Artist: _______

Tel. ______________

Certificate of non-receipt of benefits at the birth of a child sample - .

According to Article 13 of Federal Law No. 81-FZ of May 19, 1995 “On benefits for citizens of the Russian Federation with children,” parents of children under the age of 1.5 years have the right to receive a monthly benefit. The law also specifies the right to receive a lump sum benefit upon the birth of a child, which can be received by one of the parents (Article 11). To receive these payments (usually the mother receives them), it is necessary to collect a certain list of documents, among which must be certificates issued to the other parent (usually the father) stating that he did not receive either a lump sum allowance for the birth of a child or a care allowance him until he reaches the age of 1.5 years.

What does a certificate of non-receipt of benefits include?

The legislation does not provide for any unified forms for these certificates. The only requirement is to confirm the father’s non-use of the right to receive leave to care for a child under 1.5 years of age. Thus, a certificate of non-receipt of child care benefits can be drawn up as follows: Signed by the general director and the chief accountant, it confirms that the father actually works in the organization, did not go on vacation and did not receive the corresponding monthly allowance. Talking about lump sum payment associated with the birth of a child, the fact of its non-receipt can be confirmed, for example, by the following certificate: This document must also be signed by the head of the organization and the chief accountant.

This document must also be signed by the head of the organization and the chief accountant. In the absence of an employer

A certificate stating that you did not receive benefits is also needed for those families in which neither the mother nor the father officially works anywhere. Usually in such cases we are talking about students or self-employed citizens. This situation requires visiting the social security department located at the place of residence of the parent (unemployed parent), or the nearest branch of the Federal Social Insurance Fund of the Russian Federation (in the case of a self-employed citizen), which issues certificates of the required sample. The source of financing for the payment of these benefits is the Federal Social Insurance Fund of the Russian Federation, therefore the employer has the right to demand a reduction in the amount of insurance contributions associated with compulsory social insurance in connection with maternity. Any documents confirming payment of benefits or non-payment must be kept by the organization for 6 years. You may be interested in: Certificate of residence at the place of residence: sample Registration of a newborn child: place of registration, procedure, documentsThe employee asked for a certificate stating that he does not receive a monthly child care benefit, and also that he was not accrued benefits for the birth of a child? In this article you will read how to properly prepare such certificates.

Monthly allowance for child care until he reaches the age of one and a half years is paid to one of the parents.

This is installed:

- in article 13 Federal Law dated May 19, 1995 No. 81-FZ “On state benefits for citizens with children” (hereinafter referred to as Law No. 81-FZ);

- clause 42 of the Procedure and conditions for appointment and payment state benefits citizens with children approved by order of the Ministry of Health and Social Development of Russia dated December 23, 2009 No. 1012n (hereinafter referred to as the Procedure).

Only one parent also has the right to a lump sum benefit at the birth of a child (Article 11 of Law No. 81-FZ and Clause 25 of the Procedure).

When assigning these child benefits to one of the parents (usually the child’s mother), among other documents, reliable information from the other parent (father) is required to confirm that:

- he is not on parental leave and child care benefits are not paid to him until he reaches the age of one and a half years (sub-clause “g”, clause 54 of the Procedure);

- a lump sum allowance for the birth of a child was not assigned to him (sub-clause “c” of clause 28 of the Procedure).

Sample certificates

The form of a certificate of non-receipt of monthly child care benefits is not established by law. Specialists from the Federal Social Insurance Fund of the Russian Federation explain that the certificate should only contain information about whether the father used the right to parental leave for a child up to one and a half years old or not. It is not necessary to provide other additional information in this certificate (letter of the Federal Social Insurance Fund of the Russian Federation dated September 14, 2011 No. 14-03-11/15-10658) (see sample 1).

Sample 1 Certificate of non-receipt of child care benefits for children under one and a half years old

The form of a certificate of non-receipt of a one-time benefit at the birth of a child is also not established by law. We suggest using sample 2 below.

Sample 2 Certificate of non-receipt of a one-time benefit at the birth of a child

![]()

When certificates are not issued by the father’s employer

In some cases, the parents (one of them) do not have an employer. This happens if one or both parents:

- do not work (do not serve);

- study full-time in educational institutions of primary (secondary, higher, postgraduate) vocational education;

- belong to the category of self-employed citizens.

The absence of an employer for the child's father does not relieve the mother of the need to confirm that he did not receive child benefits.

If the father doesn't work. In this case, the father, who is not in an employment relationship, obtains a certificate from the social welfare department at his place of residence (subsection “c”, clause 28 and subsection “g”, clause 54 of the Procedure).

The father belongs to the category of self-employed citizens. If the second parent (father) is an individual entrepreneur, lawyer, or notary, then he does not issue a certificate of non-receipt of benefits to himself.

For a certificate of non-receipt of benefits, which the child’s mother will present at her place of work, the self-employed father must contact the territorial office of the Federal Social Insurance Fund of the Russian Federation (subparagraph “h”, paragraph 28 and subparagraph “m”, paragraph 54 of the Procedure).

How long to keep certificates in the company where they are submitted?

A monthly allowance for caring for a child until he reaches the age of one and a half years, as well as a lump sum allowance for the birth of a child, is paid from the funds of the Federal Social Insurance Fund of the Russian Federation (Article 4 of Law No. 81-FZ). They reduce the amount of insurance premiums for compulsory social insurance in case of temporary disability and in connection with maternity, subject to transfer to the fund (Part 2 of Article 15 of the Federal Law of July 24, 2009 No. 212-FZ).

The company is obliged to retain documents confirming the calculation and payment of insurance premiums for six years (clause 6, part 2, article 28 of the Federal Law of July 24, 2009 No. 212-FZ). During the same period, you must also keep certificates of non-receipt of benefits by the second parent.