Immediately after giving birth, parents begin the troublesome task of collecting documents for child subsidies, because mothers certain period lose their ability to work, and the costs of maintaining children increase. The national and local budgets of the Russian Federation provide for payments for the maintenance of children, as well as one-time assistance at the birth of a child. Parents should promptly study the laws that protect their rights, know what documents are needed to apply for children's monthly benefits, and how the state cares about the health and well-being of young citizens.

Federal compensation is made from the state budget in all regions of Russia. Local children's subsidies finance regional governments through departments social protection. They are in the nature of additional compensation for a certain period, helping parents solve financial problems during the loss of working capacity to care for a child.

Types of subsidies for children

To apply for child benefits, you need to know what basic and additional child benefits are provided for by the laws of the Russian Federation:

- One-time payments - assistance during pregnancy and childbirth, a one-time subsidy at the birth of a child or upon his adoption, one-time assistance to the wife of a military man.

- Monthly payments - assistance with child care, subsidies for the child of a military personnel in service, as well as compensation for children under 3 years of age.

All payments are made according to the situation of the parents (employed, unemployed, students, military personnel, etc.) by enterprises, educational institutions, or local social security authorities. Even before the birth of a newborn, parents need to prepare in advance a list of documents for applying for child benefits in order to receive legally guaranteed assistance as quickly as possible after birth. Working women and full-time students who register early for pregnancy can count on another type of one-time payment at their place of work or study.

How to apply for one-time children's subsidies, and what certificates are needed for this

Maternity assistance is paid at the place of work or study upon presentation of a certificate of incapacity for work during the period of maternity leave, prenatal and postnatal leave. Its size is 100% of average earnings. To receive maternity pay, the company must provide the following documents: an application for leave and a certificate of incapacity for work. If a woman is registered for pregnancy before 12 weeks, she must attach a certificate from the antenatal clinic and a corresponding application to receive additional one-time assistance in the amount of 543.67 rubles.

Documents for a one-time child benefit for the birth of children are submitted within 6 months after the child’s birth at the place of work (study) of one of the spouses. If both parents are unemployed, certificates and an application are submitted to the local social protection department. In 2016, the amount of birth assistance was 14,497.80 rubles per child.

To receive one-time assistance for the birth of a child, you need to know what documents are required for registration child benefit:

- Application requesting assistance for the birth of a child.

- A certificate from the second spouse’s place of work or study stating that he did not apply for assistance.

- Certificate of birth of the baby from the maternity hospital.

- A copy of the children's birth certificate.

When adopting or establishing guardianship over a child, the procedure for obtaining one-time assistance is identical, and a copy of the court decision on guardianship or adoption is added to the package of certificates. Thus, guardians are given equal rights with other parents, giving one of them the opportunity to take out maternity leave and use assistance provided by the state in raising children.

Another type of one-time assistance can be used by the wife of a conscript. If her pregnancy is more than 180 days. The one-time payment in 2016 is 22,958.78 rubles and is made at the social protection departments at the place of residence. To do this, you need to know what certificates should be presented:

- Application requesting payment.

- Certificate from the military unit at the place where the husband completed his military service upon conscription.

- A copy of the marriage certificate.

- Certificate from the antenatal clinic regarding pregnancy registration.

How to apply for monthly child support

When time runs out maternity leave, and the woman decides to continue raising the baby on her own. She has the right to continue leave when the child reaches the age of 1.5 years and to receive monthly assistance in the amount of 40% of the full monthly salary for the last two years. If the mother is registered at the employment center, her unemployment payments will be stopped without deregistration, with the right to receive subsidies from the social protection authorities. If the mother is a full-time student, she can choose to receive a monthly benefit either from the moment the baby is born or at the end of maternity leave.

To register monthly allowance For a child under 1.5 years old, you must provide a package of documents to the social protection department:

- Application requesting assistance.

- Original and copy of the children's birth certificate.

- Certificate from place of work (employment center, educational institution) of the second spouse that he did not apply for the subsidy.

Parents who were unemployed at the time of the birth of their children have the right to contact the social protection department and receive minimum monthly subsidies for a child up to one and a half years old in the form of state social security.

The documents required to obtain child benefits if the father is a conscript are submitted to the social protection authorities:

- Application requesting a monthly subsidy.

- A certificate from the military unit indicating the length of service, about the child’s father’s conscription service.

- Child's copy of birth certificate.

- Monthly payments are made until the child reaches the age of three, no later than the end of the child’s father’s term of service.

Documents for children's subsidies in social security after 3 years

Parents (guardians) who are on parental leave to care for a child under three years of age, according to the laws of the Russian Federation, can receive subsidies for children under 18 years of age in the case. If the family's total monthly income is less than the subsistence minimum. Child benefits should be applied for at local social protection authorities, where it is necessary to provide a certain package of certificates confirming the right to receive compensation. One of the parents or guardian has the right to this type of compensation.

In all regions of the Russian Federation, amounts of about 250 rubles are established for receiving subsidies for children under 14 years of age. The minimum income threshold for each family member, as well as the amount of payments, is determined by local authorities. To receive such compensation, you must provide an application and a list of certificates to the social security service for the assignment of child benefits - a birth certificate of the child (children), information about income from the work of the parents, a passport of the parent or guardian, a copy of the work book if the applicant is unemployed.

In Moscow, a monthly child benefit is paid until he reaches the age of majority - that is, until he turns 18 years old. The right of families to receive a monthly subsidy is enshrined in the “Law of the City of Moscow on Monthly Child Benefits,” as amended dated December 5, 2012, No. 64.

Who receives monthly child benefit?

Claim for allowance of 1000 rubles monthly only those families can:

- who have permanent residence in the capital;

- whose income per family member does not exceed the subsistence level. In 2014 this amount was 11861 ruble.

The amount of the benefit, as well as the cost of living, is constantly indexed. At the same time, few people know about the benefit, mistakenly believing that they cannot be included in the category of low-income families.

Consider the situation:

Dad receives 30 thousand rubles a month.

Mom receives 30 thousand rubles a month.

At first glance, the family's income exceeds the permissible limit for receiving benefits. However, on parental leave, for example, when a child is between 1.5 and 3 years old, the mother does not receive more than 50 rubles, so the income per family member is less than 11,861 rubles. Thus, the family can qualify for a monthly child benefit.

Attention! At the same time, funds from the rental of housing, vehicles, trailers are also taken into account (there is such a column in the application for the benefit).

What documents will be needed

To apply for benefits, you will need documents from the place of work of both parents.

From dad you will need:

- Certificate 2-NDFL for the last 6 months. That is, if you submit documents in July, then the certificate must indicate the months from January to June.

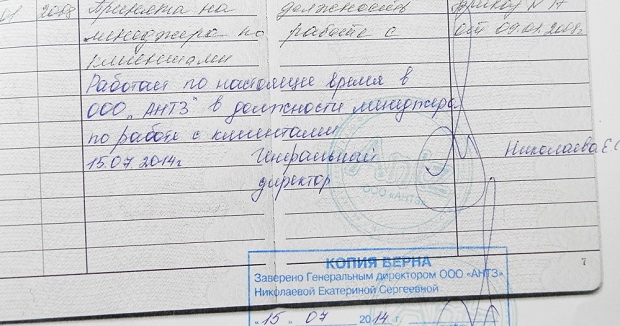

- A copy of the work book with the obligatory inscription at the end: “Working to the present time. Date".

The mother is required to:

- A copy of the work book with the obligatory inscription at the end: “Working to the present time. Date"

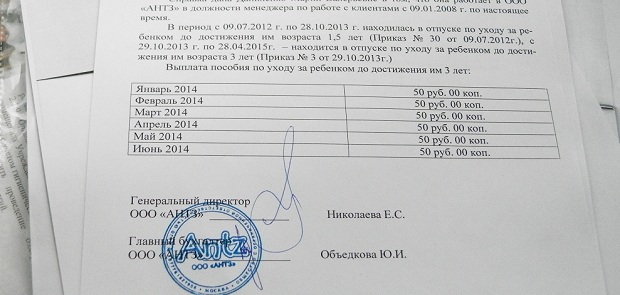

- A free-form certificate on company letterhead stating that

- Mom works in this company;

- from this to this I was on maternity leave for up to 1.5 years, order number;

- from this to this I was on maternity leave for a child up to 3 years old, order number;

— compensation payments for the last 6 months.

The certificate is signed by the manager and chief accountant.

Documents must be submitted to the social protection authorities or the multifunctional center (MFC) at the place of residence of one of the parents.

Don't forget to attach to the above documents:

- Marriage certificate.

- Birth certificates of children.

- Passports of both parents.

- Information on the bank card or savings book where the benefits will be transferred. It must be Sberbank. Social security authorities do not work with other banking systems.

- SNILS for the parent for whom you are applying for benefits.

If you found out about the benefit “late”, that is, the child is already 2 years old, then you will be paid the “debt” - for the previous 6 months.

You must verify your income annually. And if one of the parents’ official earnings has increased, then it will be enough to report this, according to the MFC employees, when you come to the social security authorities next time - in a year.

The material was prepared by Maria Danilenko.

Irina

if a mother has less than 3 children, does not work and is not on the labor exchange, then she is not entitled to benefits.

Elena

City payments of 1000 rubles: I provided all the documents that you listed above, they started paying me, I quit my job a month later, should I continue these payments for a year?

With the arrival of a baby in the family, his parents have the right to count on a certain state support- monthly child benefits. Payments of funds are made in the form of basic fixed amounts for each category of citizens, minimum and maximum dimensions such payments, there are some peculiarities in each individual region of the Russian Federation. Any monthly child benefits are a measure that helps not only to support the baby, but also to lay the foundations for its diversified development.

The sequence of calculation and accrual of payments in 2015 will not change compared to 2014; the amounts will only be recalculated taking into account the expected inflation within five and a half percent.

Any government assistance can be obtained only upon presentation of birth (adoption) documents confirming the appearance of the baby in the family. You will need to contact the MFC or the HR department (accounting) at work, collecting the necessary package of documents. Applicants can be both parents and other family members on leave. Important condition for guardians - have Russian citizenship on the date of birth (adoption) of the newborn.

In order to calculate subsidies, the aggregate information on income for the last two years of work is taken as a basis, the average monthly earnings are calculated, and the final payments will be equal to 40 percent of the received indicator.

Fixed amounts are received by parents whose average monthly income does not exceed the minimum wage, or whose work experience is less than six months, or who have not worked before. In 2015, the minimum amount of monthly subsidies for the first child will be 2,718.35 rubles, for the second and subsequent children - 5,436.67 rubles.

Maximum monthly child benefit for an infant up to 1.5 years old for parents (guardians) dismissed: during pregnancy and childbirth, maternity leave or during care leave, in connection with the liquidation of the enterprise, it is 10,873.36 rubles.

The indicated amounts may change upward at the discretion of regional authorities. Today the State Duma is actively discussing the issue of a possible extension of state subsidies for children under three years of age.

No changes are expected compared to 2014. As before, the monthly benefit for a child under 3 years old is 50 rubles and is paid from the funds of the organization with which the employment contract is concluded, or by the state. This amount may vary in regions, with changes in the corresponding coefficients. For example, in Moscow it reaches 1,600 rubles (if the guardian or parent’s income is less than the subsistence level).

If payments will be made by social security authorities, the mother (guardian) of the child must submit:

- originals and copies of passport, birth certificate and work book;

- a certificate from the regional employment service stating that parents (guardians) are not receiving unemployment benefits;

- a copy of the passbook or agreement with the bank to open a card account where the funds will be received;

- application of an approved sample.

To receive compensation payments through the accounting department of an enterprise (organization), you need to write a corresponding application.

Help will stop being paid only if the recipient has written a letter of resignation at work, receives unemployment benefits, a child under 1.5 years old is fully provided for by the state, and parents have been deprived of parental rights.

Benefits after three years

Parents (adoptive parents) of the second and subsequent children receive , the amount of which in 2015 will also be indexed and will be about 450 - 460 thousand rubles.

After three years, only low-income citizens whose total family income is less than/equal to the local subsistence level per each family member are entitled to receive benefits from the state according to local coefficients.

Subsidies up to 16 years of age

Only one of the parents of children of preschool and school age (residing in the Russian Federation) from families classified as low-income is entitled to receive a state subsidy, the amount of which varies in each individual region. Monthly child benefits can also be received by trustees, guardians, as well as adoptive parents of the child, or citizens of foreign countries living in Russia. The subsidy is awarded until the children graduate from a general education institution (but not more than 18 years of age).

On average throughout the country, the amount of subsidies up to the 16th birthday is about 300 rubles and is paid by social security authorities. In Moscow, the subsidy amount is 800 rubles, for single mothers – 1,600 rubles. In Rostov and Volgograd – 297 rubles, in Krasnodar region– 144 rubles.

The benefit is accrued only to children living with parents or guardians. You will need to submit:

- copies of parents’ passports, birth certificates (establishment of paternity, adoption) and marriage certificates;

- a certificate from local government authorities stating that the child lives with his parents;

- a certificate of parents’ income from their place of work for the last three months before the application;

- a certificate from the employment center (if the parents do not work) and a copy of the work record book;

- a certificate from a general education institution stating that the child is studying;

- application of the established form with the specified bank account where the funds will be transferred.

Subsidies up to 18 years of age

The basic allowance for a child under 18 years of age is provided to low-income families (one parent or guardian). The size varies in each region of Russia. To receive it, you will need to submit to the social security authorities or the local branch of the MFC:

- passport and a copy with a page indicating the place of registration;

- a certificate of residence of the second spouse (if the marriage is not dissolved);

- a certificate of family income for the last three months;

- copies and originals of parents’ work records;

- a certificate from local government authorities stating that the child lives with his parents;

- certificate from school;

- birth certificate;

- application with the specified bank account number of the applicant.

The size of the subsidy for single-parent families will be doubled, for a family where one of the parents evades paying child support - by half.

State assistance to military wives

Size government payments families in which one of the parents undergoes emergency military service on call, does not change. The amount of the subsidy is 9,839.48 rubles. Wives of military personnel will receive such a payment from the date of birth of the child (until his third birthday), but not ahead of schedule his father's conscription into the ranks of the Russian Armed Forces. The payment does not apply to the families of contract soldiers and military school cadets. The mother will receive the subsidy for the entire duration of her husband’s service (one year) and no longer, provided that the marriage is officially registered. To apply for benefits, you need to collect the following documents:

- passport and birth certificate of the child (original and copy);

- marriage certificate (original and copy);

- a document from the military registration and enlistment office confirming the service of the child’s father;

- application of the required sample.

With the specified kit, contact the social protection authorities at the place of residence.

Female recipient state benefits, serving in the Armed Forces of the Russian Federation, receives benefits for general rules based on the child's age.

State benefits are significant help, especially for large families. There are three main areas of government funding:

- federal one-time;

- federal monthly;

- regional.

For Muscovites there are several special programs to help young people, families with many children and low-income families. These include:

- a one-time payment that can be received within a year after the birth of the child;

- an additional amount of money if the parents of the newborn are under 30;

- various monthly payments, which will depend on the composition and income of the family. Below you can find out more detailed information about each of the benefits listed.

For the current year, its amount is 14,497 rubles 80 kopecks. The specified amount is paid once for each (from the second) child.

Documents must be submitted to the mother’s place of work, or, if the mother is unemployed, to the father’s place of service.

What you need to present:

- Statement;

- A certificate received from the registry office confirming the registration of your child;

- Child's certificate;

- A certificate from work (or from the State Tax Service) from the second parent confirming that he was not accrued the corresponding allowance;

- If parents are unemployed, they need to contact the RUSZN and submit all possible documents with which they can establish what they currently lack work activity(work books, diplomas, etc.).

Additional lump sum payments for the birth of a third child in Moscow

In addition to the general lump sum payment, parents can receive regional benefits, depending on their place of residence. In Moscow they include:

- one-time compensation;

- additional benefit to support young families.

The amount of the lump sum payment depends on the number of children. For the firstborn it will be 5,500 rubles, for each next child the state will allocate 14,500 rubles. If three (or more) children are born on the same day, then regional capital will increase to 50,000 rubles.

- Passports;

- Certificates (+ copies thereof) for all children;

- Marriage certificate;

- A certificate confirming that the child lives with a parent registered in Moscow. It is necessary if the second parent is not a Muscovite.

Benefit for young families in Moscow

Young families (those with parents under 30 years of age) can receive another regional benefit. It will amount to five times the subsistence level for the first child, 7 times for the second and 10 times for the third child. The cost of living in the fourth quarter of 2014 was 12,145 rubles.

The following are entitled to payment:

- A family where both parents are Muscovites;

- One parent registered in Moscow with a child;

What needs to be submitted to RUSZN:

- Passports;

- Testimonies of children;

- Referral from the Civil Registry Office.

Monthly allowance for caring for a third child in 2017

Paid for up to one and a half years. The right to receive it is given to those who actually care for the child (parents, guardians, relatives, etc.).

To apply for benefits, working citizens must contact the FSS (fund social insurance), non-working - in RUSZN.

The amount of payment for the first-born is 2,576 rubles 63 kopecks, for subsequent children - 5,153 rubles 24 kopecks.

If a person caring for a child is officially employed, then the amount of the benefit will be 40% of his average earnings, it is not less than the specified amounts.

Monthly child benefit for Muscovite families

Large families in Moscow can receive a monthly benefit, which will be valid until the child reaches adulthood. For complete families, its amount will be 750 rubles, for single parents with many children – 1,500 rubles.

Only those parents whose income is not higher than the subsistence level in their region will be able to receive such compensation.

What needs to be presented to the social security authorities:

- Certificate of family composition;

- Certificate of income;

- Passports;

- Testimony of children.

Maternity capital for a third child

May be paid when, if not previously received, at the birth or adoption of a second child.

Conditions for receiving:

- Citizenship of the Russian Federation for the person applying for payment and, in the future, for the born/adopted child;

- The child was born/adopted no earlier than January 1, 2007 and no later than December 31, 2016.

The amount of family (maternity) capital for the second or third child is calculated by year.

| Year | Indexation (%) | Size (RUB) |

|---|---|---|

| 2018 (forecast) | 0 | 453 026 |

| 2014 | 5 | 429 408 |

| 2015 | 5,5 | 453 026 |

| 2016 | 0 | 453 026 |

| 2017 | 0 | 453 026 |

You can exercise your right to capital by contacting your branch of the Pension Fund.

To do this you need to prepare:

- application of the appropriate sample;

- children's testimonies;

- court decision (if we are talking about adoption);

- certificate of pension insurance;

- passport;

- documents confirming the child’s citizenship.