Benefits have increased since July 1, 2017. New amounts and examples of calculating child, maternity and hospital benefits in connection with the new minimum wage are in the article.

From July 1, the federal minimum wage will be 7,800 rubles. per month instead of the previous 7,500 rubles. If your salary is tied to the minimum wage, do not forget to review it. In addition, benefits will change from July 1, 2017. For sizes and examples of calculating new benefits, see this article.

Benefits from July 1, 2017: minimum wage amounts for calculation

Minimum benefits have increased since July 1, 2017. The minimum earnings for calculating benefits for two billing years will be 187,200 rubles. (RUB 7,800 × 24 months) or RUB 256.44. per day (RUB 187,200: 730 days). This change will affect the calculation of sick leave and maternity leave in two cases. In particular when:

- the company pays benefits to an employee whose insurance coverage is less than six months;

- actual earnings are less than the minimum.

Moreover, both of these situations can occur simultaneously. The new minimum wage will also change the amount of child care benefits from July 1, 2017.

- 7800 rub.

- new federal minimum wage from July 1, 2017.

Amounts and examples of calculating benefits from July 1, 2017: earnings below the minimum wage

Benefits will change as of July 1, 2017. But only the sizes. Calculation in in this case usual, just take the minimum wage instead of the employee’s salary. Use the minimum wage that is set on the day of illness or maternity leave (Part 1.1, Article 14 Federal Law dated December 29, 2006 No. 255-FZ). Starting from July 1, 2017, the minimum wage is 7,800 rubles.

Example:

“The employee fell ill on June 30. So, use 7,500 rubles in the calculation. If July 1, then 7800 rubles. In this case, it does not matter during what periods the illness or maternity leave occurs. The main thing is what month their first day fell, that is, the insured event. If an employee is working part-time at the time of illness or maternity leave, the minimum wage also needs to be recalculated. Let's say, if an employee works part-time, take 3,900 rubles to calculate benefits. (RUB 7,800: 2).”

If the employee’s actual average daily earnings for the last two calendar years are less than the minimum, then determine the benefit based on the minimum earnings. If regional coefficients have been established in your region, the benefit calculated from the minimum wage must be increased by them (clause 11.1 of the Regulations, approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375).

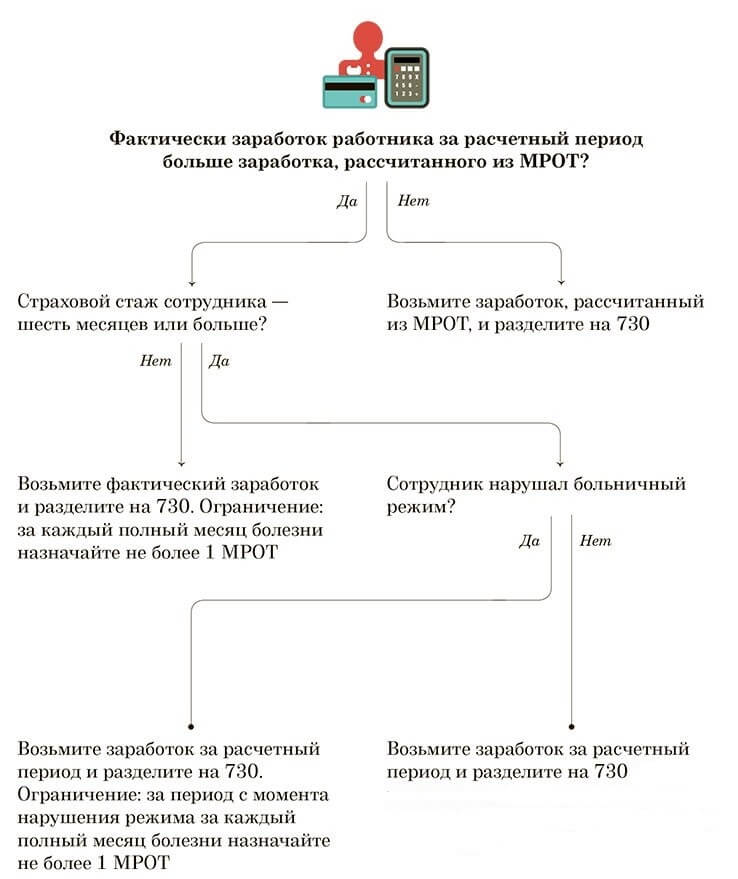

When calculating sick leave, take into account the employee's insurance record. In this situation, it does not matter what earnings you use when calculating - actual or minimum.

Example:

“The employee was ill for eight calendar days, from July 14 to July 21, 2017, inclusive. The employee has been registered with the company since January 11, 2017, this is his first place of work. The billing period is 2015-2016. The employee had no income during this period. His experience is more than six months. The employee initially worked part-time and now works full-time. To calculate the benefit, you need to take a new minimum wage, and in full - 7800 rubles. The amount of sick leave will be: 7800 ₽ × 24 months. : 730 days × 60% × 8 days. × 1.3 = 1230.90 rub. At the same time, the company’s share accounts for 461.59 rubles. (for the first three days), and the share of the Social Insurance Fund - 769.31 rubles. (for the remaining five days).”

Benefits from July 1, 2017: examples of calculation for less than six months of service

Sick leave and maternity pay cannot be more than the minimum wage for a calendar month, taking into account regional coefficients, if the employee’s length of service is less than six months. That is, the benefit may be less - it all depends on the actual earnings of the employee in the billing period.

Thus, first calculate the benefit based on the actual or minimum earnings, and then based on the minimum wage. And pay the employee the lesser of these two amounts. Moreover, when calculating from the minimum wage, do not take into account experience. Also, the amount of sick leave will not exceed the minimum wage if the employee violated the regime.

Example:

“We use the condition of the previous example. But let's assume that the employee joined the company in March. This means his experience is less than six months. Let's calculate the maximum benefit amount: 7800 ₽: 31 days. × 8 days = 2012.90 ₽, where 31 is the number of days in July, and 8 is the number of days of illness. This is more than 1,230.90 rubles, which was calculated from the minimum wage. This means that in this case the employee needs to be credited 1,230.90 rubles.”

Transitional benefits from July 1, 2017: amounts, calculation examples

If an employee gets sick or the employee goes on maternity leave before July 1, the new minimum wage needs to be used only if the amount of the benefit was limited to the minimum wage. That is, in a situation where the experience is less than six months. The specific algorithm depends on what you consider - sick leave or maternity leave.

Sick leave. This benefit is accrued after the employee has recovered. Therefore, you can immediately calculate it taking into account the new minimum wage.

Example:

“The employee was sick from June 28 to July 4, 2017 inclusive (seven calendar days in total). The billing period is 2015-2016. The employee works full time; regional wage coefficients have not been established in the region. During 2015-2016, the employee had no income. At the time of illness, his insurance coverage was less than six months. This means that the amount of the benefit cannot exceed this amount: 7500 ₽: 30 days. × 3 days + 7800 ₽: 31 days. × 4 days = 1756.45 ₽, where 30 days. and 31 days - the number of days in June and July, and 3 days. and 4 days - the number of sick days in these months. Now let's define minimum size benefits. To do this, let’s take the minimum wage as of the date of illness - June 28: 7500 ₽ × 24 months. : 730 days × 60% × 7 days. = 1035.62 rub. This amount is less than 1756.45 rubles. This means that the employee needs to be credited 1,035.62 rubles.”

Maternity. This benefit is paid before maternity leave. If the employee went into it before July 1, and it continues after that, then the amount of maternity leave must be recalculated taking into account the new minimum wage and the difference must be paid. In this case, no statements from the employee are required.

Example:

“The employee went on maternity leave from June 5 to October 22, 2017 inclusive. She joined the company in February 2016. This is the first place of work. This means that at the time of going on maternity leave, her work experience is less than six months. The employee works full time; regional wage coefficients have not been established in the region. Before the maternity leave, the accountant calculated the amount of the benefit as follows. The billing period is 2015-2016. The employee had no income at that time. In this case, the minimum amount of daily earnings will be 246.58 rubles. (7500 ₽ × 24 months: 730 days). But since the length of service is less than six months, the amount of the benefit cannot be more than one minimum wage for a full calendar month. With daily earnings of 246.58 rubles. the amount of the benefit will exceed the minimum wage in those months in which there are 31 days (246.58 days × 31 days = 7643.98 ₽). That is, in July and August. This means that for these months you need to pay 7,500 rubles. In addition, 31 days are also in October. Let's calculate the benefits for this month, as well as for other months in which maternity leave falls:

246.58 days × 26 days = 6411.08 ₽ (for June);

246.58 days × 30 days = 7397.40 ₽ (for September);

7500 rub. : 31 days × 22 days = 5322.58 ₽ (for October).

This means that the amount of maternity benefit will be:

6411.08 RUR + 7397.40 RUR + 7500 RUR × 2 + 5322.58 RUR = 34,131.06 RUR. From July 1, the minimum wage increased to 7,800 rubles. This means that the amount of benefits for the period from July 1 needs to be recalculated. Maternity pay for July, August and October now does not exceed the minimum wage. The employee needs to pay the following amount: (7643.98 RUR - 7500 RUR) × 2 + 246.58 RUR × 22 days. - 5322.58 ₽ = 390.22 rubles.”

Amounts and example of calculating benefits for caring for the first child

Child care benefits have their own minimums. From February 1, 2017 the minimum amount monthly allowance for caring for the first child is 3065.69 rubles. And if the child is the second, third, etc. the amount of the benefit cannot be less than 6131.37 rubles. for a full month.

The minimum amount of benefit for caring for the first child will change from July 1, 2017. The benefit amount will be 3120 rubles. (RUB 7,800 × 40%). But this value should be used only if the vacation began on July 1, 2017 or later (Part 1.1 of Article 14 of Law No. 255-FZ, Clause 23 of Regulation No. 375). At the same time, the minimum for calculating benefits for caring for the second and subsequent children will not change - 6131.37 rubles.

Example:

“An employee goes on maternity leave in the summer to care for her first child. The billing period is 2015-2016. During this time, she was credited with 142,901.12 rubles. There were no excluded periods. The monthly allowance based on actual earnings will be: RUB 142,901.12: 731 days. × 30.4 days × 40% = 2377.12 rub. Let's consider two situations. The first is that maternity leave begins before July 1. Let's calculate the amount of the monthly benefit based on the previous minimum wage: 7500 ₽ × 40% = 3000 rubles. This is the employee's first child. This means that the benefit amount cannot be less than 3065.69 rubles. This amount is due to the employee for a full month, since it is more than both 2377.12 rubles and 3000 rubles. The second situation is that the vacation begins on July 1 or later. The amount of benefit from the new minimum wage will be: 7800 ₽ × 40% = 3120 rubles. This is more than 3065.69 rubles. Therefore, in this case, charge the employee 3,120 rubles. in a month."

Benefits from July 1, 2017: sick leave for calculating benefits from the minimum wage

In the lines “Average earnings for calculating benefits” and “Average daily earnings” sick leave indicate the amounts that you used when calculating the benefit. That is, indicate 187,200 rubles on the sick leave. and 256.44 rubles, if you counted sick leave or maternity leave from the minimum wage. In this case, provide a detailed calculation of the benefit on a separate sheet.

Benefits from July 1, 2017: transition to electronic sick leave

On July 1, 2017, another amendment will come into force - the law on electronic certificates of incapacity for work (Federal Law of May 1, 2017 No. 86-FZ). From this date, electronic sick leave will no longer be mandatory. But all clinics that connect to the information interaction system will be able to issue them. To work with electronic sick leave, the company will need a personal account at cabinets.fss.ru.

After the clinic and the employer connect to the electronic exchange, the employee decides whether to take a paper ballot or an electronic one. If an employee chooses a virtual slip, he must give written consent to the doctors. The Ministry of Labor has already developed a consent form, but so far it is only a draft.

Upon discharge, the employee will be given a sick leave number. With this number he goes to the accounting department. The accountant enters the number into the database, finds out the necessary information for calculating benefits and issues benefits on such a sheet, as well as on a regular one.

Indexation of benefits is the process of increasing the earnings and savings of citizens by the state during inflation. In today's topic we will analyze the process. Will citizens' benefits be increased, and if so, which ones? Among other things, at the end of the article there will be a detailed table that will clearly show indexation of benefits from July 1, 2017, benefit amounts and types of benefits that will be increased.

Indexation of benefits from July 1, 2017 – will it happen or won’t it?

Let's start with the fact that we will call an increase in wages and benefits only conditionally by indexation. Because as such indexation of benefits from July 1, 2017 there won't be. This is due to the fact that no resolution was issued from the Government of the Russian Federation approving indexation by the specified deadline. But at the same time, for example, the minimum wage will increase from 7,500 to 7,800 rubles. Therefore, some changes are still awaiting us. Let's look at which ones exactly.Increase in average earnings (minimum wage)

The amount of maternity, sick leave and child benefits is calculated according to the following scheme. This is the average earnings for two years before the start of benefits. For example, to determine what size sick leave benefit should be received by an employee who fell ill in 2017, the average amount of earnings for 2015 and 2016 is calculated. In this case, there is a fixed amount, less than which the benefit cannot be in any case. In this case, to calculate the amount of benefits, they are based on the minimum wage (minimum wage). If we start from indexation of benefits from July 1, 2017, then the minimum wage will be equal to 187,200 rubles(7,800 rubles × 24 months). This is the minimum amount of benefit in an insured event (illness, maternity leave or parental leave).If the insured event (illness, maternity leave or parental leave) occurred after July 1, 2017,

To calculate the minimum average daily earnings, the formula is used:

Minimum wage at the time of illness, maternity leave or vacation × 24 / 730 = minimum average daily earnings.

If we take into account indexation of benefits from July 1, 2017, then the minimum average daily earnings will be 256 rubles per day. This is the minimum daily wage for calculating the benefit amount.

This number is taken into account in the following cases:

- In the last two years before receiving benefits, there was no income at all or it was less than the minimum

- The employee has been at his current place of work for less than six months

- Or if the hospital regime was violated

Increasing the amount of the minimum child care benefit

Child care benefits are paid every month and amount to 40% of average earnings. However, the resulting amount, again, should not be less than the minimum. From May 19, 1995, the amount of child care benefits is as follows. To care for the first child – 1,500 rubles per month, for the second, third and further – 3,000 rubles per month.Indexation as of February 1, 2017 made the amounts of minimum child care benefits from July 1, 2017 as follows. For the first child - 3065.69 rubles, for the second, third and further - 6131.37 rubles.

Process indexation of benefits from July 1, 2017 will also be directly related to the minimum wage craze. If we calculate the amount of the minimum benefit amount from the new minimum wage, then the amount of child care benefits from July 1, 2017 will be 3,120 rubles. It is noteworthy that at the same time minimum allowance for caring for the second and subsequent children are not subject to change and will remain 6,131 rubles.

Increasing the amount of the minimum maternity benefit

To determine the amount of the minimum maternity and maternity benefit from July 1, 2017, let's turn to the formula that will help calculate the amount of minimum earnings per day. Based on Part 1.1 of Art. 14 of Law No. 255-FZ, the amount of minimum earnings is calculated as follows:Minimum wage at start time maternity leave× 24 / 730 = minimum average daily earnings

The current minimum wage, approved by the Government on February 1, 2017, is 7,500 rubles.

If maternity leave began from February 1 to June 30, 2017, then the minimum average daily earnings is 246 rubles. The following amounts of maternity benefits are currently relevant:

- 34,521 rubles in the general case;

- 47,835 rubles at multiple pregnancy

- 38,465 rubles for complicated childbirth

Benefit amounts from July 1, 2017:

- 35,901 rubles in the general case

- 49,749 rubles for multiple pregnancy

- 40,004 rubles for complicated childbirth

Benefit indexation table from July 1, 2017

Let's summarize the innovations in benefit amounts from July 1, 2017 and present the values in table form. On the left are values since February 1, 2017, and on the right benefit amounts from July 1, 2017. We remind you that it is not the amount of benefits itself that has increased, but the amount of the minimum benefit based on the amount minimum wage labor.Benefit | From February 1, 2017 | From July 1, 2017 |

| Maximum monthly child care benefit | 23 120, 66 rub. | 23 120, 66 rub. |

| Minimum amount of maternity benefit | RUB 34,521.20 – in the general case; RUB 47,835.62 – during multiple pregnancy; RUR 38,465.75 - during complicated childbirth. | · RUB 35,901.37 (256.438356 × 140 days) – in the general case; · RUR 49,749.04 (256.438356 x 194 days) – in case of multiple pregnancy; · 40,004.38 rub. (256.438356 x 156 days) – for complicated childbirth. |

| Maximum amount of maternity benefit | RUB 266,191.8 – in the general case; RUR 368,865.78 – during multiple pregnancy; RUB 296,613.72 - during complicated childbirth. | · RUR 266,191.8 – in the general case; · RUR 368,865.78 – during multiple pregnancy; · RUR 296,613.72 - during complicated childbirth. |

| Minimum amount of benefit for child care up to one and a half years old | 3065.69 rubles – for the first child; 6131.37 rubles – for the second and subsequent children. | · 3120 rubles – for the first child; · 6131.37 rubles – for the second and subsequent children. |

| Maximum monthly allowance for child care up to 1.5 years | RUB 23,120.66 | RUB 23,120.66 |

| Allowance for registration in early dates pregnancy | RUB 613.14 | RUB 613.14 |

| One-time benefit for the birth of a child | RUB 16,350.33 | RUB 16,350.33 |

10 May 2017, 21:36

Due to the increase in the minimum wage to 7,800 rubles, the amount of child benefits has changed since July 1, 2017. What are the new child benefit levels? Is it necessary to recalculate benefits already assigned? Has the minimum amount of child care benefits increased? What are the amounts of maternity benefits? With such questions, employees are happy to turn to the human resources department (despite the fact that the accounting department, as a rule, is responsible for calculating benefits). Therefore, we will consider the changes in the amounts of child benefits from July 2017 in more detail, and we will also provide a convenient table with the new amounts of child benefits.

What benefits are considered “children’s”

- ;

- ;

- monthly allowance for child care up to 1.5 years;

- maternity benefits (“maternity benefits”).

At the same time, we note that in some regions of the Russian Federation there is a pilot Social Insurance Fund project underway to pay benefits directly from the fund’s budget. FSS units in the experimental regions themselves calculate and pay “children’s” benefits to employees.

If an organization or individual entrepreneur has employees to whom he is obliged to pay “children’s” benefits, then the employer should know the amount of benefits, including the amount of child benefits from July 1, 2017. So, let's talk about the sizes that have changed several times (including indexed) this year.

Benefit amounts in January 2017

There has been no indexation of child benefits since January 1, 2017. Therefore, in January 2017, employers should have paid child benefits to employees in the same amounts as in 2016. We present in the table the amounts of benefits, which are determined by law in fixed amounts and are subject to annual indexation:

| Amounts of child benefits in January 2017 | |

|---|---|

| Benefit | Size in January 2017 |

| Benefit for registration in early pregnancy | RUB 581.73 |

| One-time benefit for the birth of a child | RUB 15,512.65 |

| Care for the first child - 3000 rub. | |

| Caring for a second child - 5,817.24 rubles. | |

February indexation 2017

As we have already said, the “children’s” benefits shown in the table are subject to annual indexation. At the same time, maternity benefits (“maternity benefits”) are not subject to state indexation.

In 2017, legislators provided for indexation of 1.54% from February 1, 2017 (Government Resolution Russian Federation dated January 26, 2017 No. 88). In this regard, the amount of “children’s” benefits has increased since February. Here are the indexed sizes:

| Amounts of child benefits from February 1, 2017 | |

|---|---|

| Benefit | Size in January 2017 |

| Benefit for registration in early pregnancy | 613, 14 rub. (RUR 581.73 x 1,054) |

| One-time benefit for the birth of a child | 16,350, 33 rub. (RUB 15,512.65 x 1,054) |

| Minimum amount of benefit for child care up to 1.5 years | Care for the first child - 3065.69 rubles. (RUR 2,908.62 x 1,054) |

| Caring for a second child - 6131.37 rubles. (RUB 5,817.24 x 1,054) | |

Regional coefficients

In districts and localities where regional coefficients for wages have been established, “children’s” benefits (both in January 2017 and from February 1, 2017) will be higher - they must be additionally increased by the amount of the increasing coefficient (Article 5 of Law No. 81 -FZ).

Child benefits from July 1, 2017

From July 1, 2017, the minimum wage increased to 7,800 rubles. But did such an increase affect the amount of child benefits from July 1, 2017? Let's look at this in more detail.

Maternity benefit

The new minimum wage (RUB 7,800) affected the calculation of maternity benefits from July 1, 2017 in the following cases:

- if there were no payments in the billing period or their amount was small;

- if the employee’s insurance experience at the time of granting benefits was six months.

What is a billing period

The billing period is the two calendar years preceding the start of maternity leave (from January 1 to December 31). Accordingly, if a woman goes on maternity leave, say, in July 2017, then the billing period will be 2015-2016.

New minimum maternity benefit amount

We immediately consider it appropriate to remind you that an employee who is assigned maternity benefits has the right to contact the accounting department to replace one or two years of the billing period with other years (if there is no earnings in the billing period or it is very small). The accountant should replace the years while simultaneously meeting 3 conditions:

- a woman wants to change the years in which she was on maternity leave or parental leave;

- the years selected for replacement precede the billing period (letter of the Ministry of Labor of Russia dated August 3, 2015 No. 17-1/OOG-1105);

- As a result of the replacement of years, the benefit amount will become larger.

But if there is no right to change years, then the accountant will need to calculate the maternity benefit from the minimum wage - in the minimum amount. In such a situation, it is necessary to determine the minimum average daily earnings using the following formula:

Minimum average daily earnings = minimum wage at the beginning of maternity leave x 24 / 730

From July 1, 2017, the minimum wage is 7,800 rubles. Accordingly, from July 1, the minimum average daily earnings for calculating benefits is 256.438356 rubles. (RUB 7,800 × 24 months) / 730. Here is an example of calculating child benefits from July 1 using the new average daily earnings:

An example of calculating maternity benefits from July 2017

A.V. Nikolaeva wishes to go on maternity leave from July 28, 2017. The billing period is from January 1, 2015 to December 31, 2016. There was no earnings during the billing period. Insurance experience – 7 months. The regional coefficient does not apply. The minimum average daily earnings is 256.438356 rubles. (7800 rubles × 24 months) / 730. Daily allowance – 256.438356 rubles. (RUB 256.438356 × 100%). As a result, the amount of A.V.’s benefit Nikolaeva for 140 calendar days of maternity leave, calculated from the minimum wage in the minimum allowable amount, will be 35,901.37 rubles. (RUR 256.438356 × 140 days).

Let us recall that maternity leave is a legally established paid period of 140, 156 or 194 days, which is entitled to every woman to give birth to a child and restore her health.

Until July 1, 2017, the minimum wage was set at 7,500 rubles. And if maternity leave began in 2017 (from February 1 to June 30), then the minimum average daily earnings for calculation maternity benefit should be taken equal to 246.575342 rubles. (RUB 7,500 × 24 months / 730). This value is used for further calculation of benefits if it turns out to be greater than the actual average daily earnings of the employee. The minimum amounts of maternity benefits before June 30, 2017 were as follows:

- RUB 34,520.55 (246.575342 rubles × 140 days) – in the general case;

- RUB 47,835.62 (246.575342 rubles x 194 days) – in case of multiple pregnancy;

- RUR 38,465.75 (RUR 246.575342 x 156 days) – for complicated childbirth.

From July 1, 2017 the minimum size maternity payments you need to calculate from the new minimum average daily earnings 256.438356 rubles. Here are the new values of minimum maternity benefits from July 1, 2017 for different lengths of leave:

- RUB 35,901.37 (256.438356 × 140 days) – in the general case;

- RUB 49,749.04 (256.438356 x 194 days) – in case of multiple pregnancy;

- RUB 40,004.38 (256.438356 x 156 days) – for complicated childbirth.

Let's compare the minimum values of maternity benefits from the latest minimum wages in the table:

If the experience is less than 6 months

At the start of maternity leave, a woman’s work experience may be less than six months. This happens, for example, if this is your first job. Then maternity leave for a full calendar month should not exceed the minimum wage (Part 3, Article 11 of Federal Law No. 255-FZ of December 29, 2006). In areas with regional coefficients - in an amount not exceeding the minimum wage, taking into account such coefficients.

When calculating maternity benefits for less than six months of service, you should use the minimum wage in effect in the month the maternity leave begins. That is, if the vacation began, for example, in June 2017, and ended in October, then in order to limit the amount of benefits in June, you need to rely on the minimum wage in the amount of 7,500 rubles, and in July, August, September and October - 7,800 rubles. The maximum daily allowance for each month must be calculated by the accountant using the following formula:

How is the minimum benefit calculated for less than 6 months of service?

Maximum daily benefit for less than 6 months of service = minimum wage in force in the month of vacation / number of calendar days in the month of maternity leave

Accordingly, if we are talking, say, about maternity leave in July 2017, then the maximum daily benefit for this month will be 251.6129 rubles. (7800 rubles / 31 days), since in July 2017 there are 31 calendar days. Let us give an example of calculating benefits in such a situation.

Example of calculation for less than 6 months of experience

L.S. Sadovskaya has been going on maternity leave since June 21, 2017. It will end on November 8, 2017. In the billing period from January 1, 2015 to December 31, 2016, she has no income. Insurance experience – 5 months and 1 day. The regional coefficient does not apply.

Let's determine the average daily earnings from the minimum wage, which was applied at the beginning of maternity leave (that is, in June). The average daily earnings will be 246.58 rubles. (RUB 7,500 × 24 months / 730 days). Accordingly, the daily allowance will be 246.58 rubles. (RUR 246.58 × 100%).

The maximum daily benefit depending on the number of calendar days is as follows:

- in June – 250 rub. (7500 rub. / 30 calendar days);

- July, August and October – 251.6129 rub. (7800 rubles / 31 calendar days);

- September and November – 260 rub. (7800 rub. / 30 calendar days).

Now let’s compare the amount of the daily allowance from the minimum wage with the maximum daily allowance for each month of maternity leave. And it turns out that the daily allowance from the minimum wage does not exceed the maximum daily allowance in all months of maternity leave:

- RUR 246.58< 250 р.;

- RUR 246.58< 251,6129 р.;

- RUR 246.58< 260 р.

Thus, the accountant has the right to calculate the allowance from the daily allowance calculated from the minimum wage - 246.58 rubles. As a result, the amount of benefit to L.S. Sadovskaya for 140 calendar days of maternity leave will be 34,520.54 rubles. (246.58 rubles × 140 days), where 140 days is the duration of maternity leave.

Maximum sizes of maternity

As for the maximum amounts of maternity benefits, they have not changed since July 1, 2017, since maximum size The minimum wage has no effect. To calculate the maximum amount of maternity leave from 2017, you need to take into account the maximum amount of average daily earnings. It is calculated using a formula that takes into account not the minimum wage, but the maximum values of the base for calculating insurance contributions to the Social Insurance Fund for the billing period.

In 2015, the maximum value of the base was 670,000 rubles. (Resolution of the Government of the Russian Federation dated December 4, 2014 No. 1316), and in 2016 – 718,000 rubles. (Resolution of the Government of the Russian Federation dated November 26, 2015 No. 1265).

That is, in 2017, the maximum average earnings are taken into account as 1901.37 rubles. (RUR 670,000 + RUR 718,000) / 730. Accordingly, as can be seen from the table below, the maximum limits from July 1, 2017 remained at the same levels.

Child care benefit from July 1, 2017

The employer must pay child care benefits to the employee monthly in an amount equal to 40% of average earnings, but not less than the minimum amount (Clause 1, Article 11.2 of Federal Law No. 255-FZ of December 29, 2006).

The minimum care allowance has increased

The minimum basic amount of child care benefits is established by Part 1 of Article 15 of the Law of May 19, 1995 No. 81-FZ and is:

- when caring for the first child - 1500 rubles. per month;

- when caring for the second and subsequent children - 3000 rubles. per month.

These amounts are annually indexed by the appropriate coefficient. Taking into account all indexation coefficients, as of February 1, 2017, the minimum child care benefits were as follows:

- RUB 3,065.69 – for the first child;

- 6131, 37 rub. – for the second and subsequent children.

However, due to the increase in the minimum wage, the minimum amount of child benefit will increase from July 1, 2017. After all, the amount of the minimum benefit (for the first child) from July 1, 2017 cannot be less than the amount calculated from the new minimum wage, namely 3,120 rubles (7,800 rubles x 40%). However, you should only use the new value if your maternity leave started on or after 1 July 2017. At the same time, the “minimum wage” for caring for the second and subsequent children does not change. It remains in the amount of 6131 rubles on and after July 1.

The maximum care allowance has not changed

The maximum amount of child care benefit is not limited. However, the amount of average daily earnings on which this benefit is calculated is limited.

It has been established that the amount of average daily earnings for calculating benefits cannot be greater than the sum of the maximum values of the base for calculating insurance premiums for the two years preceding the year of parental leave, divided by 730 (Part 3.3 of Article 14 of Law No. 255-FZ ). Therefore, to calculate the maximum amount of average daily earnings, use the formula:

Maximum average daily earnings = sum of the maximum values of the base for calculating Social Insurance contributions for the two previous years / 730

Therefore, if a woman’s vacation begins in 2017, then in the calculations we should take the values of the maximum values of the base for calculating contributions to the Social Insurance Fund for 2015 and 2016

Taking into account the indicated values for the marginal base, in 2017 the maximum value of the average daily earnings for calculating the monthly care allowance is 1901.37 rubles. (RUR 670,000 + RUR 718,000) / 730. That is, the calculations apply exactly the same principle as when determining the maximum maternity benefit.

Now let’s calculate the maximum average earnings for a whole month. For these purposes, we multiply the average daily earnings by the average monthly number of calendar days - 30.4 (Part 5.1 of Article 14 of Law No. 255-FZ). In 2017, the maximum average monthly earnings for calculating benefits will be 57,801.64 rubles. (RUR 1,901.37 × 30.4).

The amount of the monthly childcare benefit for a child up to 1.5 years old is generally equal to 40% of the average monthly earnings (Part 1, Article 15 of Law No. 81-FZ). Therefore, in 2017, the maximum amount of monthly benefit per child will be 23,120.66 rubles. (RUB 57,801.64 × 40%). This maximum amount of child care benefit applies throughout 2017. And, as you can see, the increase in the minimum wage from July 1, 2017 simply could not affect it

Recalculation of child benefits

If the right to leave to care for the first child arose before July 1 and the accountant calculated the minimum benefit (RUB 3,065.69), then no recalculation should be made. However, if the vacation began on July 1, 2017 or later, then the woman is entitled to 3,120 rubles for each month. Accordingly, if you paid the woman less, then you need to recalculate and pay extra.

You will also need to review and pay additional maternity benefits if, after July 1, 2017, you assigned them without taking into account the increased minimum wage in the cases described above (no earnings in the billing period or less than six months of service).

Benefit amounts from July 1: summary table

So, we have shown with examples how changes in the minimum wage affected the amount of child benefits from July 1, 2017. However, some “children’s” benefits have not changed in any way due to the increase in the minimum wage. To make it easier for the personnel officer to navigate the amounts of benefits in 2017, we have summarized the final values of “children’s” benefits in a single table. You can use its code to contact the HR department for advice from employees. You can also submit it to the accounting department.

| Child benefits from July 1 | |||

|---|---|---|---|

| Benefit | From January 1, 2017 | From February 1, 2017a | from July 1, 2017 |

| Benefit for registration in early pregnancy | RUB 581.73 | 613, 14 rub. | 613, 14 rub. |

| One-time benefit for the birth of a child | RUB 15,512.65 | 16,350, 33 rub. | 16,350, 33 rub. |

| Minimum monthly allowance for child care up to 1.5 years | • care for the first child - 3000 rubles; • care for the second and subsequent children 5,817.24 rub. | • care for the first child – 3065.69 rubles; | • care for the first child – 3120 rubles; • care for the second and subsequent children - 6131.37 rubles. |

| Maximum child size | RUB 23,120.66 | ||

| Minimum amount of maternity benefit | • 34,520.55 rubles - in the general case; • 47,835.62 rub. - during multiple pregnancy; • 38,465.75 rub. - during complicated childbirth. | • 35,901.37 rubles – in the general case; • 49,749.04 rubles – for multiple pregnancy; • 40,004.38 rub. - during complicated childbirth. |

|

| Maximum amount of maternity benefit | • 266,191.8 rub. (RUR 1,901.37 × 140 days) – in the general case; • 368,865.78 rub. (RUR 1,901.37 × 194 days) – for multiple pregnancies; • 296,613.72 rub. (RUR 1,901.37 × 156 days) – for complicated childbirth. |

||

If you find an error, please highlight a piece of text and click Ctrl+Enter.