Support for pregnant women in Russia is carried out at the state level. Therefore, for workers who are expecting a baby, certain payments are provided.

One type of incentive is a payment for gynecological registration during the first trimester of pregnancy. Its size is established by law. The amount is indexed every year.

In order for the employer to accrue funds, an order is issued for the payment of benefits for registration in early dates pregnancy. The document is prepared on the basis of supporting papers that are issued in the LCD.

Types of state benefits

The Russian Constitution (Article 39) provides for the payment social benefits. Such support is necessary to provide for citizens who are in a disabled position.

A benefit is a cash payment given to individuals for a specified period. Accrual is possible in the absence of wages from citizens, as well as material support in socially significant cases. The last option does not consider the presence or absence of income.

Benefits are paid not only on the basis of the specified list. The list of situations in which payments are made can be supplemented. This happens when a decision is made on the need to support a certain category of persons.

For the intended purpose state benefits can be in the form of payments for:

- loss of a person's opportunity to work;

- bearing and giving birth to a baby;

- registration in the antenatal clinic for pregnancy management up to 12 weeks;

- the birth of a child;

- upbringing and care until the age of 1.5 years of the child;

- burial of a deceased person;

- unemployment.

Depending on the duration of payments, benefits are divided into one-time, monthly, periodic. Some payments rely exclusively on a limited circle of people.

Temporary incapacity for work may be a reason to pay some benefits.

They are assigned if:

- diseases or injuries that temporarily limit the ability to work;

- caring for a sick family member;

- temporary transfer to another type of labor activity;

- stay in hospital, sanatorium-resort treatment.

You can confirm your incapacity with sick leave.

What is this payment and who is entitled to it

Payment of cash allowance for contacting the antenatal clinic in the early stages is carried out to women who applied to the antenatal clinic for pregnancy management before the end of the first trimester (12 weeks).

The appointment and transfer of funds is made on the basis of No. 81-FZ. You also need to focus on the Order of the Ministry of Health and Social Development Russian Federation No. 1012n.

The allowance is additional to the main one - payment of sick leave during pregnancy and childbirth.

Therefore, women can get it:

- having permanent employment;

- dismissed during the liquidation of an individual entrepreneur, enterprise;

- who are full-time students of the budgetary and commercial bases;

- who serve on a contract basis in the Ministries of Defense, Internal Affairs, fire service, bailiff service, customs organizations.

In the absence of a permanent place of employment and full-time study, the maternity allowance is not subject to accrual and payment. For self-employed women, a benefit is provided. However, it can only be obtained if she paid contributions to the FSS during the year preceding her maternity leave.

The size

woman behind early start management of pregnancy is 300 rubles. But the amount can be increased due to annual indexation, set at the federal level, taking into account the level of inflation. Regional coefficients are also applied to the allowance.

The norms are reflected in the Federal Law No. 81 and the Procedure for the payment of benefits in accordance with Order No. 1012n (paragraphs 20 and 79). For example, in 2015, the allowance amounted to 543 rubles 67 kopecks, excluding the regional coefficient.

Women who were eligible before 1 February 2016 received the 2015 amount. Since February, indexation has been carried out by 7%. As a result of this, payments amount to 581 rubles 73 kopecks.

The amount must be taken into account at the moment when the woman goes on maternity leave after 30 weeks. Even future mom registered in 2015, and the decree begins in 2016, then you need to focus on the size of 2016.

Some workers are faced with the payment of benefits without indexation. After its implementation, on the basis of the date of issue of the law, it is necessary to recalculate and pay the missing amount.

Required documents from an employee

To receive benefits, you will need to collect and submit Required documents. Among them, there is a certificate issued by the antenatal clinic on registration in the first trimester, as well as an application. A unified form of the document is not provided for by law, so you can contact the employer in any form.

The certificate is issued by the gynecologist who registered the woman. She has no special requirements. Therefore, it is possible to compile it at your discretion. medical organization. After registration, the certificate must be certified by the signature of the doctor and the seal of the institution.

The transfer of documents can be done in several ways.

Among them are:

- personal filing at the place of work;

- sent by registered mail (a photocopy of the certificate certified by a notary is sent);

- provision of an electronic version of the document.

Shipping options are highlighted by clauses 5 and 5.1 of the Procedure, which was approved by Order No. 1012n of the Ministry of Health and Social Development of the Russian Federation of December 23, 2009.

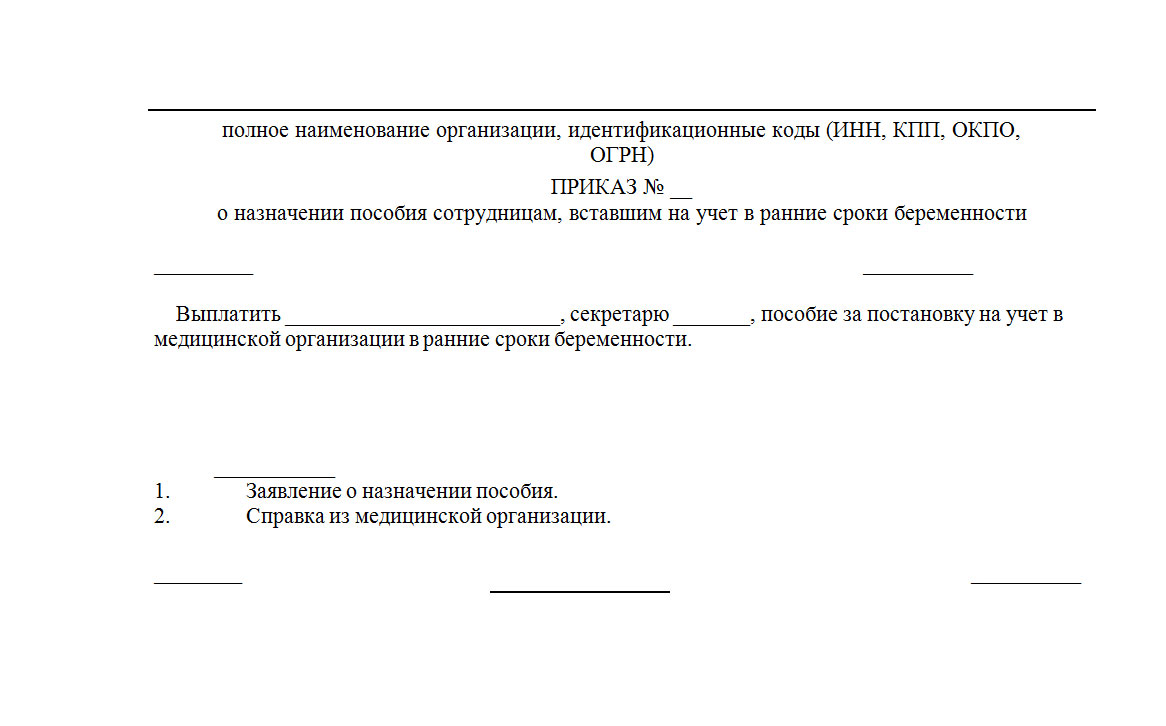

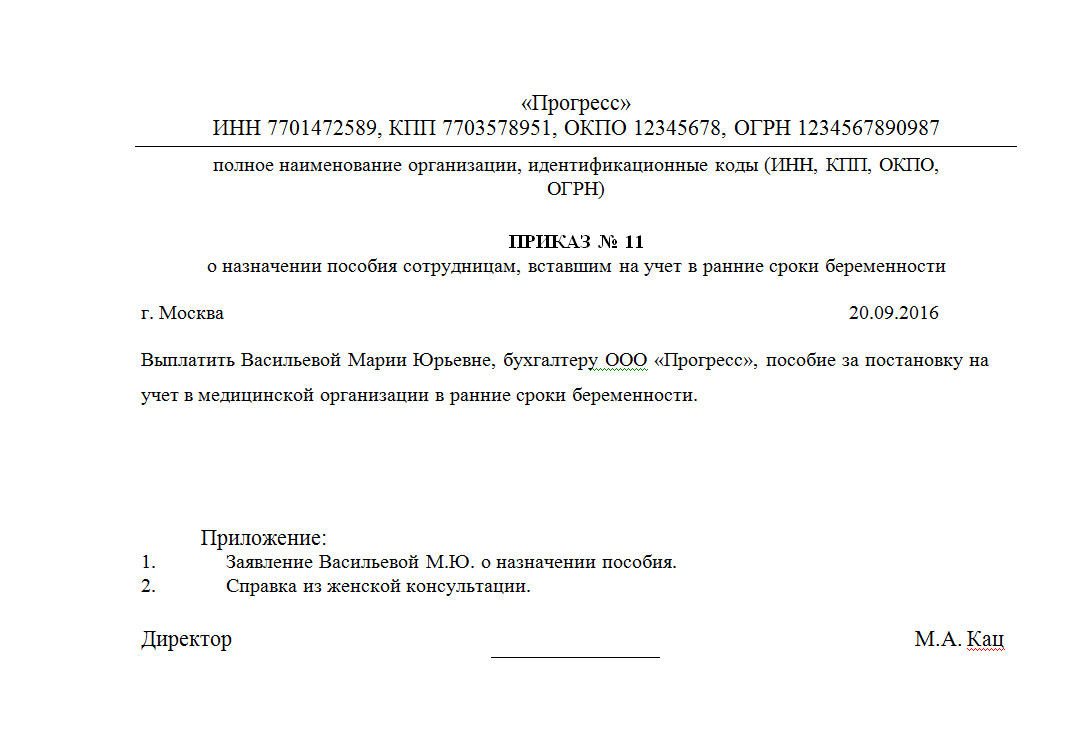

Drawing up an order for the payment of benefits for registration in early pregnancy

After the woman submits the documents (certificate and application) to the accounting department, an order is issued for the payment of benefits for registration in the early stages of pregnancy. When preparing it, you can focus on the example below.

LLC "Athletics"

Form according to OKUD 2658436 according to OKPO 5971859

Document Number

Date of preparation

№23-6 13.03.2016

(order)

about payment lump sum women registered with a medical institution in the early stages of pregnancy

Personnel Number

Krivosheeva Svetlana Grigorievna

Production Department

senior engineer 3 category

In connection with registration in a medical institution in the early stages of pregnancy, pay a one-time allowance in the amount of six hundred and thirty-five rubles (in words), taking into account the regional coefficient.

635 (in numbers) rubles 00 kopecks

Director (position) ________ (signature) Svetlov M.V.

Familiarized with the order ___________ (signature) "___" _________ 20__

Deadlines for registration and submission of documents

An application for the payment of a lump-sum allowance for early registration is possible after the issuance of a document confirming this fact. It is important not to miss the paper submission deadline, which is set six months after the end of 140 days of leave determined for bearing and giving birth to a child.

The funds deposited in this direction are paid out in a lump sum. The transfer is carried out at the moment when the accounting department calculates and transfers the prenatal allowance.

The procedure can only be carried out if the employee has provided a timely certificate of record keeping from the very beginning of pregnancy. Therefore, it is important to transfer the document along with a temporary disability certificate issued at the antenatal clinic, which is necessary for calculating the maternity benefit.

In some cases, a certificate is issued by a medical institution later than a sick leave. Then the woman needs to provide it as soon as possible in order to calculate benefits. It will be transferred to the pregnant woman's account within 10 days from the date of presentation of confirmation of the grounds for payment.

In the event of the liquidation of an enterprise or individual entrepreneur and the dismissal of a woman in connection with this, payments are made differently. The acceptance of a certificate and the calculation of benefits within a similar ten-day period are legally established. However, the funds are transferred to the FSS due to the absence of the employer. The transfer will be made by the 26th day of the month following the date of the certificate.

Display in accounting

Reimbursement of funds that are provided for the payment of benefits in connection with registration in the early stages of pregnancy is made by the FSS. The money that the organization pays, and then transferred to the FSS, is entered into the accounting records.

Payments are made to account 69. To do this, postings must be made. When calculating benefits for employees who registered early for registration, D 69 K 70 is used. At the time the allowance is issued to the employee, D 70 K 50 or 51 is posted.

Taxation

Women who are registered in the first trimester can count on state benefits.

Regardless of what taxation is used in the institution, the benefit does not accrue:

- personal income tax (on the basis of paragraph 1 of Article 217 of the Tax Code of the Russian Federation);

- contributions and deductions to the PFR, MHIF, FSS (in accordance with paragraph 1 of part 1 of article 9 of the Federal Law No. 212, issued on July 24, 2009);

- contributions required for insurance against industrial accidents and occupational diseases (reference point - part 1 of article 20.2 of the Federal Law No. 212, issued on July 24, 2009).

The benefit is fully reimbursed by the FSS. Therefore, expenses cannot be included in the expenses of the institution. In this regard, during the calculation of income tax, the amounts cannot be taken into account. This rule is reflected in Article 252 of the Tax Code of the Russian Federation.

To understand the essence of the calculations, it is necessary to consider an example. Saturn LLC uses the general taxation system. On February 15, 2016, an employee of the company I.B. Bronnikova was provided with a certificate from the antenatal clinic, compiled on February 10, 2016.

The following was reflected in the accounting records:

This amount was not included by the accountant in the funds taken into account when determining the NP. Also, the allowance did not change the amount of other taxes.

When applying a special tax regime, benefits are also not taken into account in the calculation of the single tax. This is due to the payments made by the Social Insurance Fund of the Russian Federation.

The allowance is not considered an expense, therefore, it should not be taken into account even with a simplified system, UTII. For understanding it is necessary to consider an example.

Colosseum LLC uses a simplified taxation regime, taking into account income minus expenses. On October 13, 2016, an employee of the company A.A. Ogorodnikova was presented with documentary evidence of applying to the LCD in the first trimester, drawn up on October 8, 2016.

The benefit payment was made on October 23, 2016. The following was reflected in the accounting records:

The amounts were not taken into account when calculating income tax. They also did not affect other tax collections. The payment of benefits when contacting a gynecologist at an early date is due to all working and full-time students. Therefore, if this right arises, it is necessary to provide the relevant documents to the accounting department.

For start-up companies, information on how a sample order for the payment of a lump sum at the birth of a child looks like will be extremely useful. The presence of a nulliparous woman in the team implies that sooner or later this knowledge will come in handy. As well as the very principle of receiving and complete information about this type of payment. This article contains the latest information at the moment, which will be relevant for several years for sure. Let's get to the basics.

So, the state is trying to actively support the citizens of the Russian Federation financially, creating a system of certain payments for specific cases. AT this case The interest of the government lies in one of the key tasks. The state is trying in every possible way to improve the demographic situation in the country. That is why both benefits were created, issued to all citizens, and to those who carry out labor activities.

The benefit that will be discussed in this article is issued to persons who are employed. Both the mother who works in a particular organization and, in the absence of a job, the father of the child can count on receiving benefits. Payments are transferred on the occasion of the birth of the baby. Moreover, the money is transferred to the family for each child. The amount does not depend in any way on the position, or on the financial condition, or on the income of the person who submitted the application. That is, it is a constant.

Where to issue a document

The next most important issue is the choice of the place where this allowance will be issued. In the event that both parents, or at least one of them, is employed, he should submit papers in his organization. Otherwise, it should be sent to the address of the department for the protection of citizens of a social nature, which is located at the place of residence of the family.

In 2011, certain amendments were made. Since then, most of the regions have been using the new system for receiving funds. More like a different source. Now it's a question territorial authority insurance fund of citizens of a social nature. Moreover, the appeal should be direct. If citizens are employed, then there are no changes for them. You should also send a package of documents to employers. Now let's move on to more important details - directly to the documents.

What will be required

Of course, there are differences in the documents between citizens, depending on whether they have a place of work. First of all, we will analyze the case when a citizen who is employed transfers papers to his organization. In this case, you will need:

- A single document of a citizen of the Russian Federation or its analogues confirming the identity;

- Application for the start of benefits payments;

- Documents confirming the birth of the baby and family ties;

- Confirmation that the spouse was no longer receiving childcare benefits. Of course, it is needed if both parents are employed;

- When the spouse (a) does not have a job, then a document is required from the Department of Social Protection of the Population, which also confirms that no payments were received;

- If this is a single mother, then a document from the registry office will be required. It should contain information that the baby's father was entered, according to the mother.

In the case when parents are not employed citizens, in addition to the standard set, the following papers are required:

- Books of labor activity in which there is a record that they were fired from their jobs;

- If the parents are students or simply non-working citizens, then a diploma / certificate or other document is required proving that labor activity has not been done before;

- When this is a single mother, then a document from the registry office is necessary. It should contain information that the baby's father was entered, according to the mother.

An additional document has another group of persons. This is when, for example, the baby's mother is an individual entrepreneur. In this case, you will need a document from the fund that deals with social insurance. This paper must confirm that no one received benefits for this child.

A little about the timing and the order itself

It is necessary to submit documents to a specific institution as early as possible. The most deadline is the moment when the child reaches the age equal to half a year. That is, the parent has six months left. After the deadline, it will be problematic to submit a document, and the probability of refusal is high. There must be a good reason for such a delay.

The benefit will accrue in about ten days. They will be counted from the moment the parent has provided the necessary documents, and the relevant authority has confirmed that all the papers are in place. But the transfer of funds should be expected no earlier than at the end of the month, and the next one.

Finally, I would like to provide sample order for the payment of a one-time allowance for the birth of a child. This document looks like this:

With all the information that one way or another relates to this manual, it is almost impossible to make a mistake when drawing it up. You should also periodically check the legislation on this topic for possible amendments.

When a child appears in the family, his parents can count on some help. First of all, a one-time allowance in the amount of 14,497.8 rubles is immediately paid. for 2015. If at least one of the parents of the born child is officially employed, then he needs to apply for benefits at the place of his work.

If both parents are employed, either parent can receive benefits. The amount of the allowance is indexed and approved annually federal law. The benefit is paid only once at the expense of the FSS (the unemployed receive benefits from the social security authority).

Among the documents that the parent of the child must present in order to receive lump sum payment is a statement written by employees in any form indicating a request to pay a lump sum in connection with the birth of a child. The application is accompanied by a birth certificate of the child and a certificate from the other parent's place of work on non-receipt of the specified payment. The last document is required, its original is required. You can get a certificate at the place of work of the second parent, the certificate must contain confirmation that the child's second parent was not paid benefits. This certificate allows you to exclude double payment of benefits (to each parent).

Having received from the employee with the attached documents, the employer is obliged to prepare an order for the payment of benefits at the birth of a child. This article provides an example of such an order at the link below.

How to issue an order for the payment of a lump-sum allowance at the birth of a child?

The order is usually issued by the personnel service. The form gives an order to pay the specified allowance to a certain employee of the organization, in addition, a responsible person is appointed who will control the execution of the order.

In general, the order for the payment of a lump sum should contain the following information:

- Company name;

- the word "Order";

- the date;

- room;

- name of the locality;

- the basis for the preparation of the order;

- an order to accrue and pay the allowance (indicate its amount and the full name and position of the person to whom the allowance should be paid, in addition, it is necessary to indicate for which child the allowance should be received (if there are several children, then the allowance is paid for each child);

- an order to appoint a responsible person who is entrusted with monitoring compliance with the order;

- attached documents to the order;

- order signature;

- signature of the employee upon acquaintance;

- familiarization visa of the responsible person who is entrusted with control over the execution of the order.

Order on the payment of a lump-sum allowance at the birth of a child sample -